Our best spreads and conditions

About platform

About platform

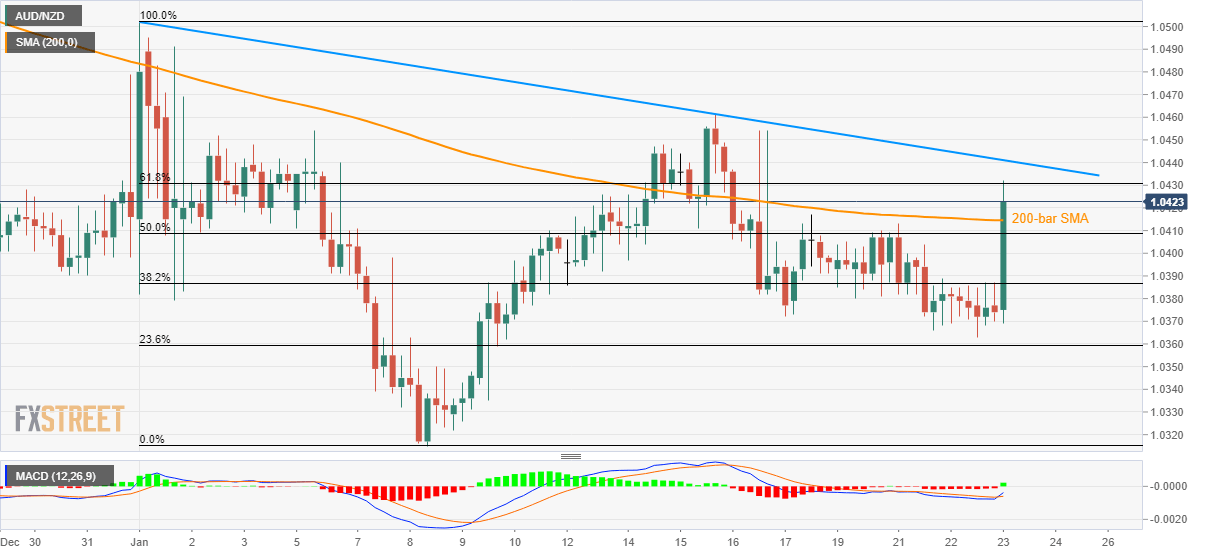

AUD/NZD surges to 1.0432, +0.50%, just after Australia’s better than forecast employment data, published early Thursday. In doing so, the pair not only surged to the highest in a week but also crossed 200-bar SMA and 61.8% Fibonacci retracement of the pair’s declines during January 01 and 08.

Read:Australia Jobs Data: Unemployment Rate: 5.1% vs 5.2% expected (AUD bullish)

As a result, the bulls will now target a downward sloping trend line from January 01, at 1.0445, as an immediate resistance, a break of which could recall mid-month top surrounding 1.0460.

During the pair’s further upside beyond 1.0460, a monthly high near 1.0500 will be in the focus.

Meanwhile, sellers will wait for the entry unless prices decline back below 23.6% Fibonacci retracement level of 1.0360. However, a 200-bar SMA level of 1.0415 can offer immediate support.

Should there be further weakness in the AUD/NZD prices below 1.0360, the current month’s low near 1.0315 may act as an intermediate halt to 1.0300 round-figure.

Trend: Bullish