AUD/USD Price analisis: The price action and levels to look for on Aussie jobs

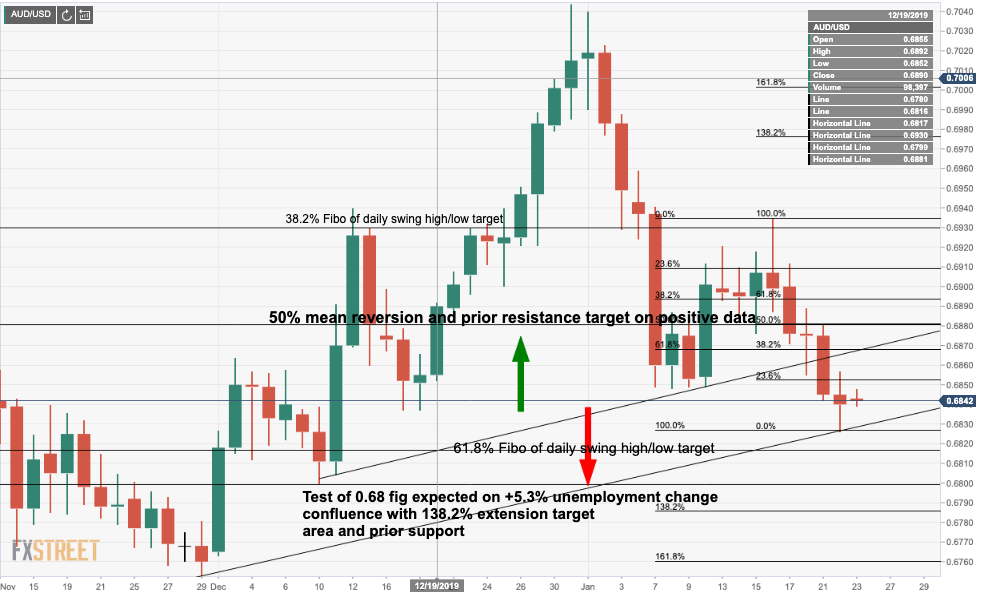

- Bullish scenario: 50% mean reversion target at 0.6880 is the focus.

- Bearish scenario: 61.8% Fibo guards 0.68 the fig confluence and 0.6755 November low.

AUD under pressure since H&S neckline break and test of daily support line below yesterdays US session fresh closing low for the year down at 0.68427. Bears scored 0.6827 channel support low, to the pip.

Bears can target the golden ratio as the 61.8% Fibonacci retracement target, 0.6820 area which will be expected to hold the initial tests. A subsequent break there will be game over the committed bulls and 0.66 will be on the cards. 0.6800 will give way to 0.6755 November low ahead of the target the 0.6671 October low

However, should the data be considered a positive outcome, from channel support, a structural bullish case could be made for a restest towards a 50% mean reversion target and prior support of the H&S neckline and 0.6880 prior resistance. On a subsequent break, bulls will be back in the picture for a more balanced bias and the upside of the channel will be back in vogue.