Back

22 Jan 2020

AUD/USD Price Analysis: Aussie under pressure near January lows

- AUD/USD is under selling pressure as the London session came to an end.

- The level to beat for bears is the 0.6835 support.

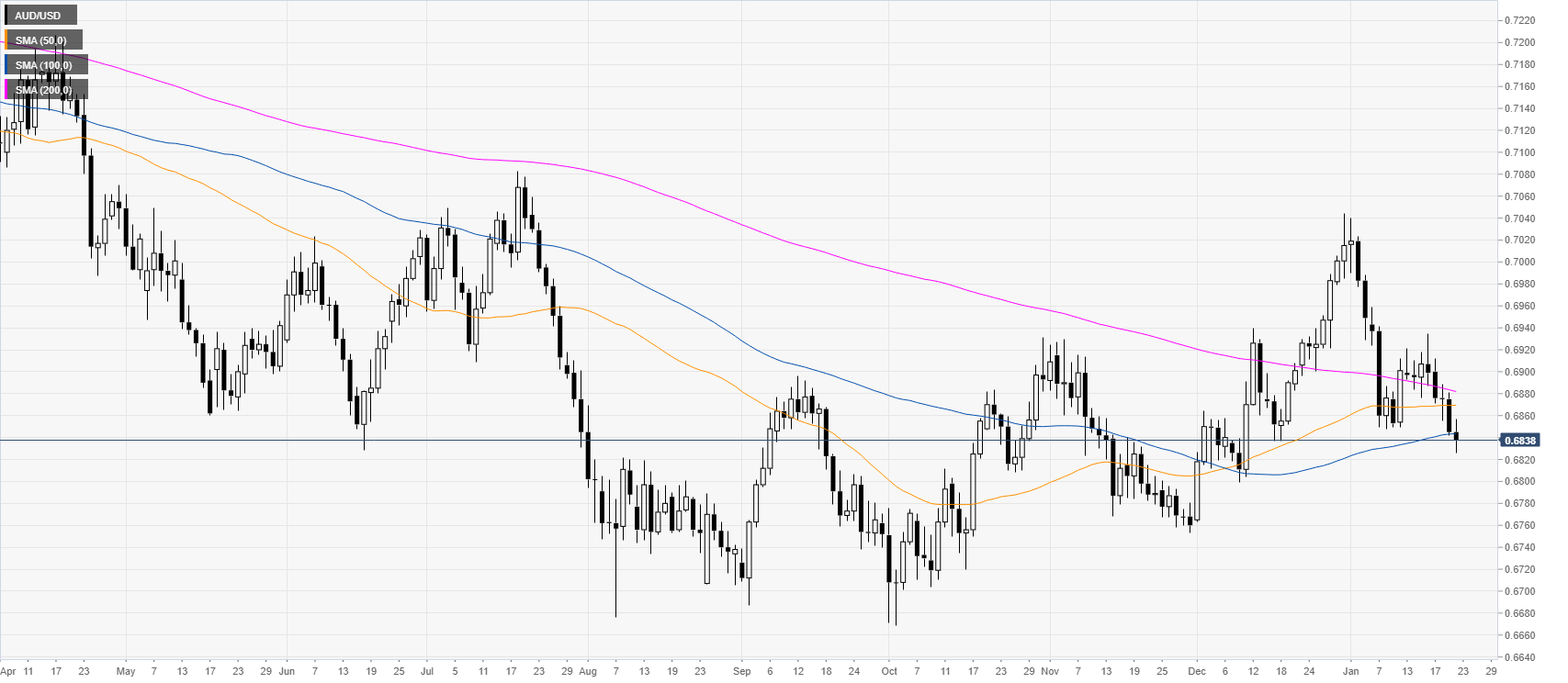

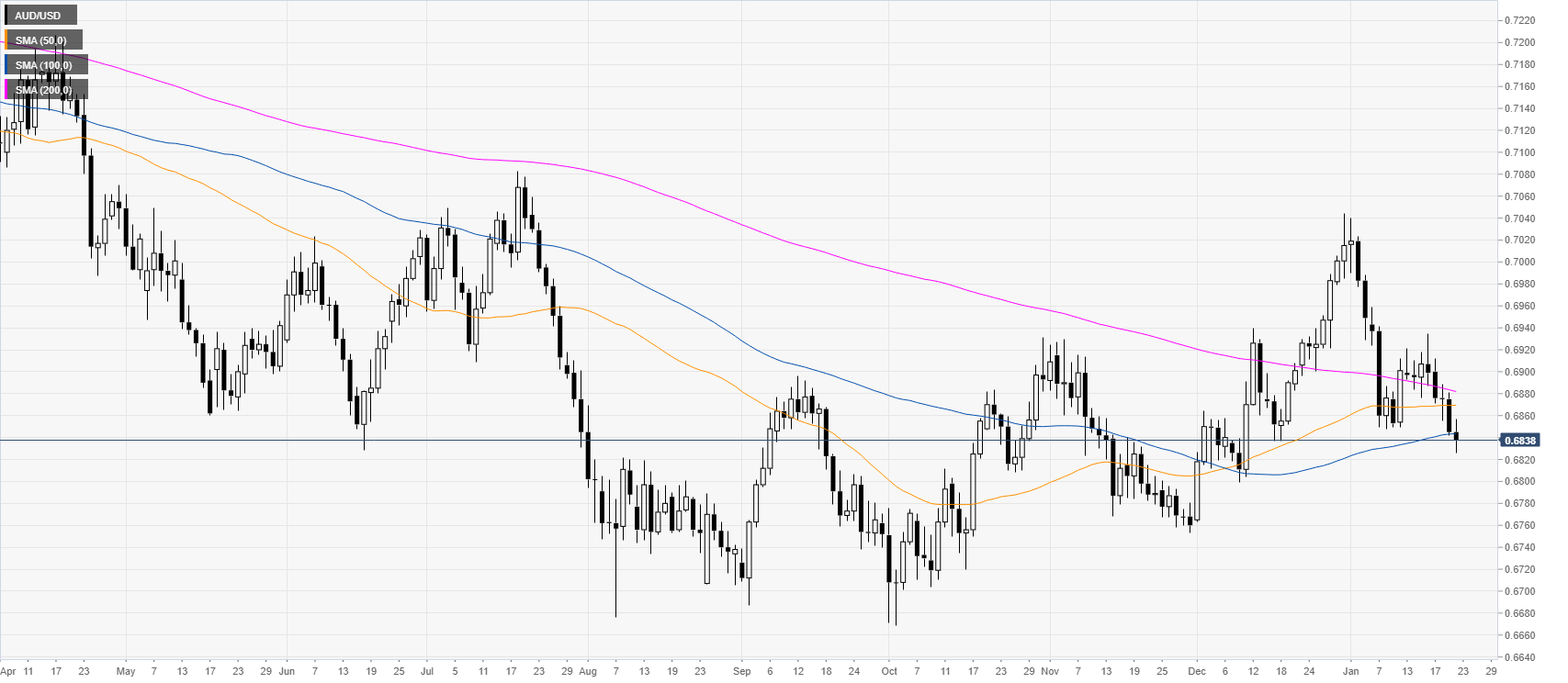

AUD/USD daily chart

AUD/USD is hovering near the monthly lows while trading below the 50/100 and 200-day simple moving averages (SMAs), suggesting an overall bearish momentum.

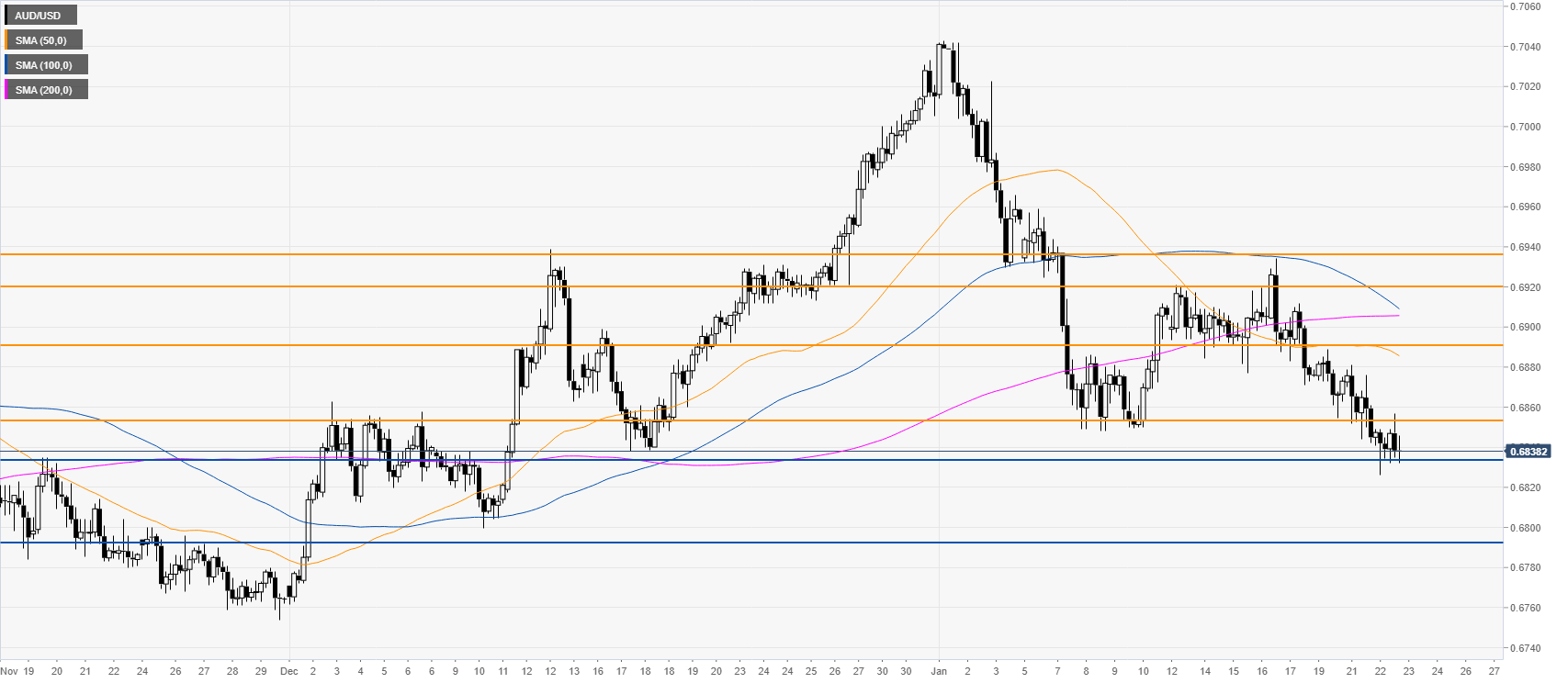

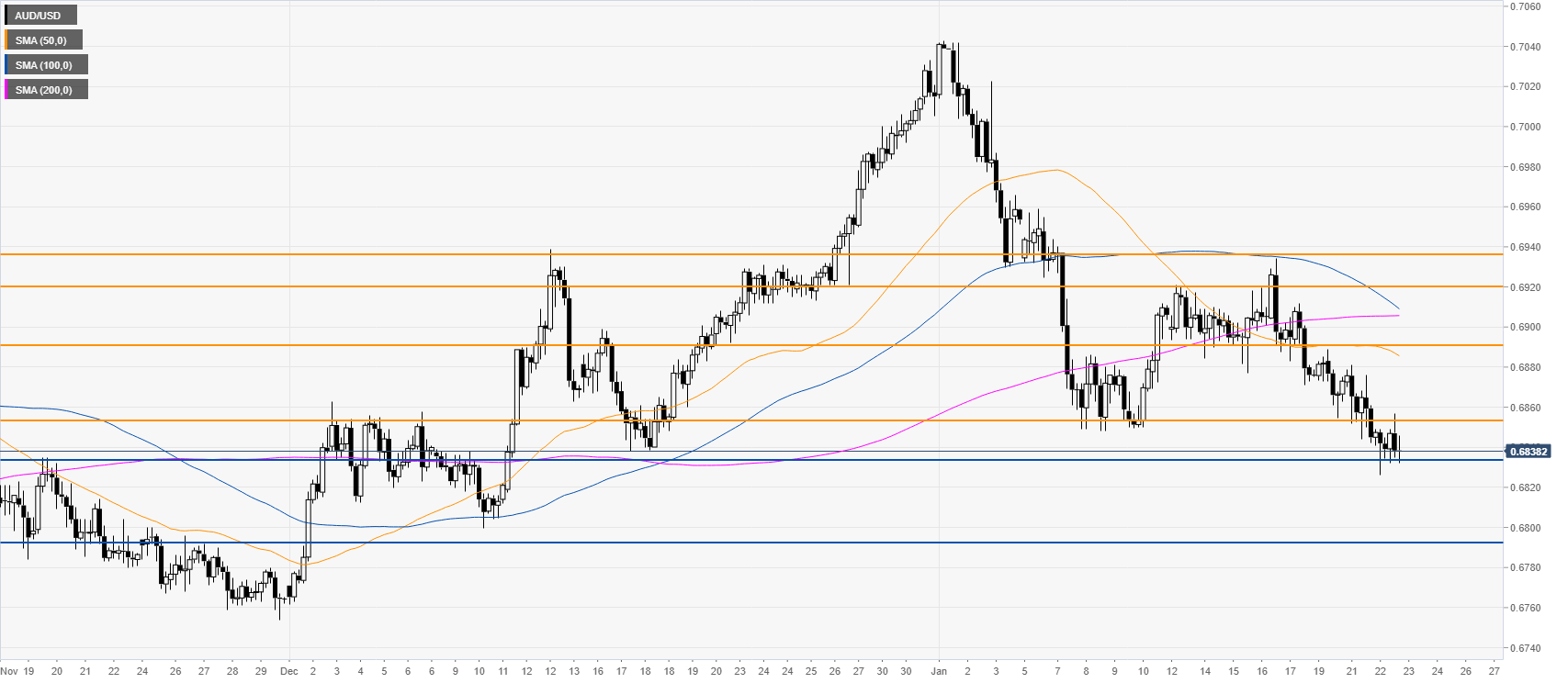

AUD/USD four-hour chart

AUD/USD is under bearish pressure below the main SMAs and the 0.6854 resistance. Bears are trying to drive the market below the 0.6835 support. A daily close below this level can lead to further downside towards the 0.6792 level, according to the Technical Confluences Indicator. Resistance is seen at the 0.6892, 0.6920 and 0.6937 level.

Additional key levels