Back

22 Jan 2020

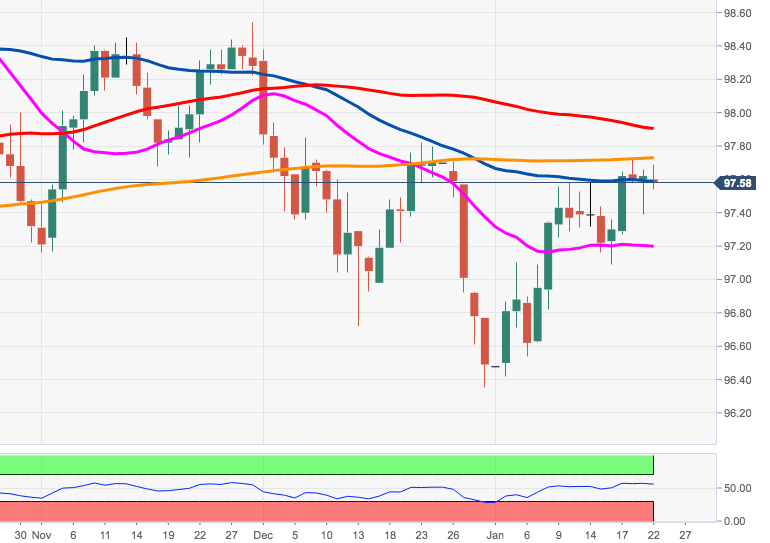

US Dollar Index Price Analysis: Upside momentum (still) capped by 97.70

- DXY is prolonging the sideline theme always below the 97.70 region.

- Above this level the outlook on the USD should shift to constructive.

The index has so met a tough barrier in the 97.70 region, where sits the key 200-day SMA and so far yearly highs.

A breakout of this area on a convincing fashion should expose a Fibo retracement of the 2017-2018 drop and the 100-day SMA, 97.87 and 97.88, respectively.

The inability of DXY to surpass recent tops – ideally in the near-term horizon – carries the potential to trigger some disappointment among bulls and therefore favour some consolidation ahead of a potential correction lower.

DXY daily chart