Our best spreads and conditions

About platform

About platform

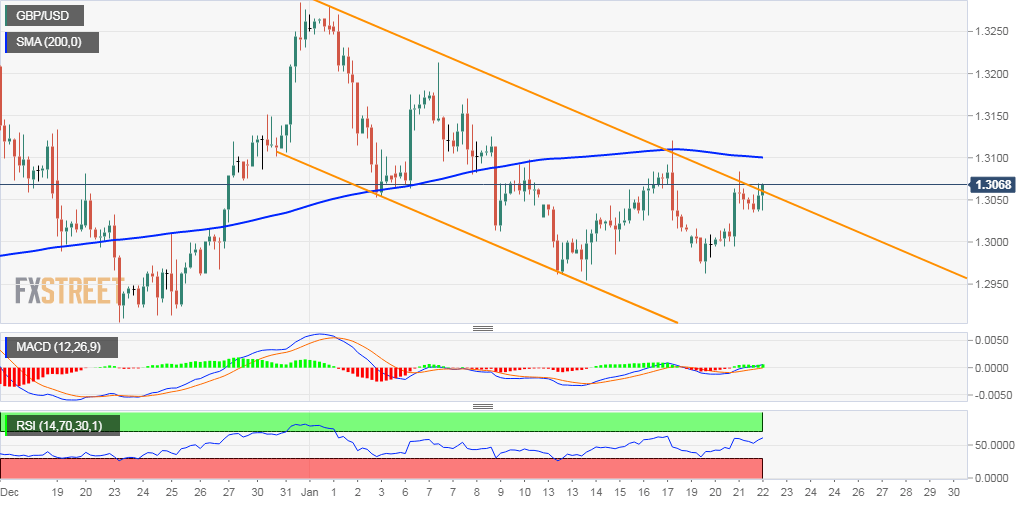

The GBP/USD pair traded with a mild positive bias for the third consecutive session on Wednesday. Bulls still await a sustained move beyond the top end of a three-week-old descending trend-channel.

This is closely followed by 200-period SMA on the 4-hourly chart, around the 1.3100 round-figure mark, which if cleared should pave the way for a further near-term appreciating move for the major.

Meanwhile, technical indicators on hourly charts have managed to hold in the bullish territory and should be seen as a positive trigger for bullish traders, supporting prospects for additional gains.

However, oscillators on the daily chart are yet to catch up with the recent positive move or gain any meaningful traction and warrant some caution for bulls amid increasing odds of a BoE rate cut.

Having said that, the pair is likely to aim towards testing its next resistance near the 1.3165-70 region ahead of the 1.3200 round-figure mark on a sustained move beyond the 1.3100 round-figure mark.

On the flip side, the 1.3035 region now seems to protect the immediate downside, below which the pair might turn vulnerable and accelerate the slide further towards the key 1.30 psychological mark.