Back

22 Jan 2020

Copper Futures: A deeper pullback looks unlikely

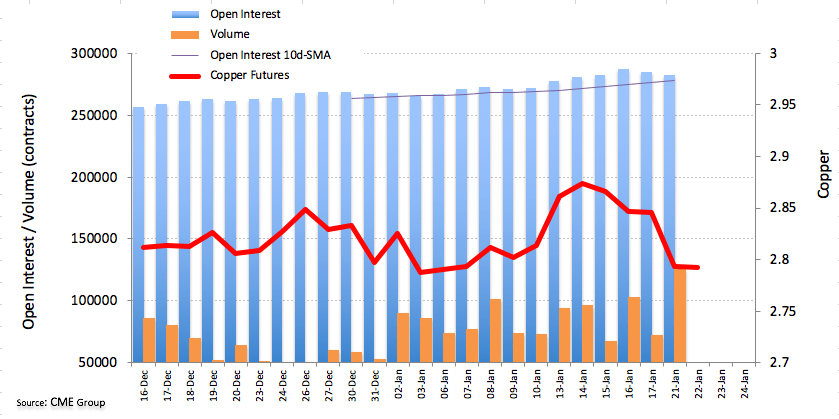

Traders scaled back their open interest positions for the second session in a row on Wednesday, this time by around 1.9K contracts, according to the preliminary report from CME Group. Volume, instead, rose by nearly 53.3K contracts, extending the choppy performance for yet another session.

Copper could see YTD lows retested

Copper prices are extending the leg lower on Wednesday following Tuesday’s drop in open interest. While further decline is not ruled out, the area of yearly lows in sub-2.76 levels is expected to act as a strong support in the short-term horizon.