GBP/USD Technical Analysis: Weakens farther below mid-1.3000s, remains vulnerable

- GBP/USD pair faded an intraday spike to levels beyond the 1.3100 handle.

- The technical set-up suggests the resumption of the prior bearish trajectory.

The GBP/USD pair extended disappointing UK retail sales data-led intraday pullback from levels beyond the 1.3100 handle and dropped to fresh session lows, around the 1.3025 region in the last hour.

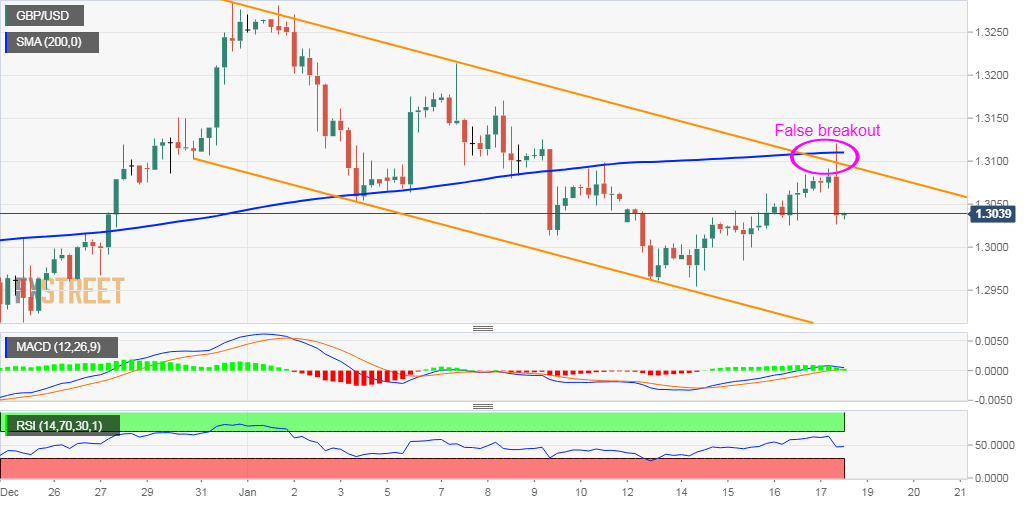

The early uptick beyond a confluence resistance – comprising of 200-period SMA on the 4-hourly chart and the top end of a three-week-old ascending trend-channel – turned out to be a false breakout.

The subsequent downfall, which erased the previous session's positive move, now point to the emergence of fresh selling pressure and support prospects for the resumption of the prior bearish trend.

Meanwhile, technical indicators on the daily chart maintained their bearish bias and have again started gaining negative momentum on hourly charts, supporting prospects for a further depreciating move.

Some follow-through selling below the key 1.30 psychological mark will reaffirm the bearish bias and turn the pair vulnerable to accelerate the slide towards weekly lows support near the 1.2955 region.

The momentum could further get extended towards the 1.2900 round-figure mark before the pair eventually drops to test the descending channel support, currently near the 1.2880-75 region.

On the flip side, any attempted recovery might now confront some fresh supply near the 1.3075 region and seems more likely to remain capped near the 1.3100-1.3110 confluence barrier.

GBP/USD 4-hourly chart