Our best spreads and conditions

About platform

About platform

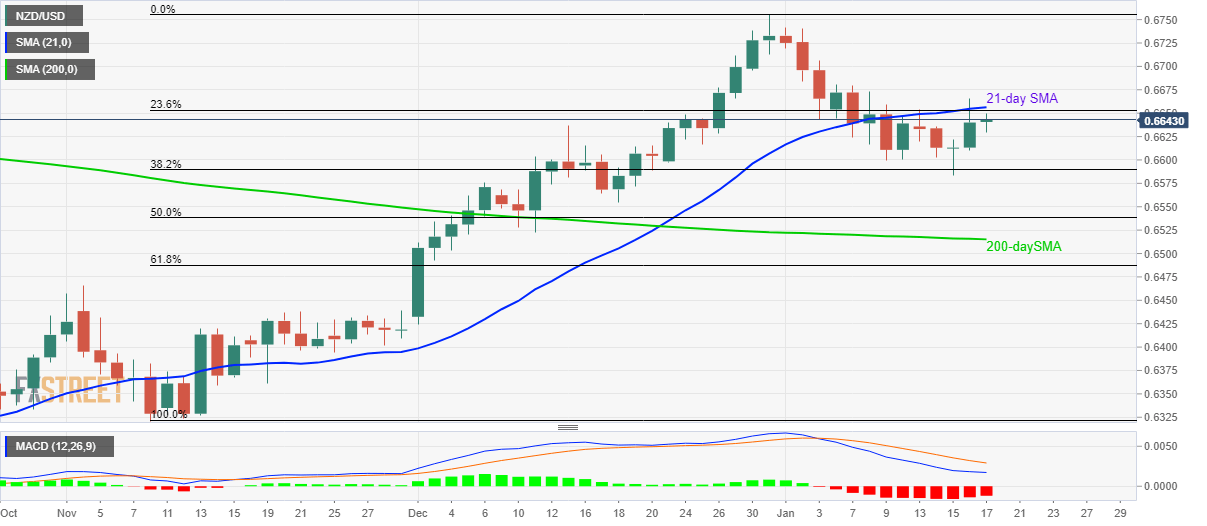

NZD/USD tetap dalam penawaran beli ringan di dekat 0,6645 saat menjelang sesi Eropa pada hari ini. Pasangan tersebut pulih dari Fibonacci retracement 38,2% dari gerakan naik November-Desember 2019. Meskipun demikian, pertemuan SMA 21-hari dan Fibonacci retracement 23,6% membatasi kenaikan.

MACD bearish mendapatkan perhatian pasar jika harga tergelincir di bawah Fibonacci retracement 38,2% di 0,6590. Akibatnya, terendah 18 Desember di dekat 0,6550 bisa menjadi favorit penjual sebelum menghadapi level SMA 200 hari di 0,6515.

Sementara itu, kenaikan di luar pertemuan 0,6655/60 bisa mendorongnya menuju 0,6700 dan kemudian ke Desember 2019 di sekitar 0,6760.

Jika bull mendominasi di atas 0,6760, tertinggi Juli 2019 di sekitar 0,6795 bisa menjadi fokus. Atau, penurunan harga NZD/USD di bawah 0,6515 dapat kembali ke puncak awal November di dekat 0,6465.

Tren: Diperkirakan mundur