USD/JPY takes on 110 handle for first time since May

- USD/JPY takes on the 110 handle as market hysteria continues supporting US/Sino phase-one trade deal.

- Key data ahead opens risks for USD and global growth sentiment.

- Bulls can target 110.50s for confluence resistance target.

USD/JPY has just taken on the 110 handle and printed a fresh high within the longer-term bull recovery at 110.12. Traders are selling the yen in the face of renewed optimism for global growth prospects for 202 on the notion that a US and Chinese trade deal will be positive for markets.

Overnight, USD/JPY extended its Asian session gains to a high of 109.94, a high since May 2019, in line with positive risk appetite. Overnight, there were reports that the US Treasury will remove China from its list of currency manipulators ahead of this week’s trade deal being signed. This boosted the US dollar and yields as well as US stocks.

The US 2-year Treasury yields edged up to 1.585% (from 1.57%) and a mild curve steepening allowed 10-year yields to test 1.85% (from 1.82%). "Fed funds futures implied a slight (1bp) rise in implied yields across the curve with the implied terminal rates up to 1.33% in early 2021, analysts at Westpac noted.

Risk-on, but for how long can markets climb before distribution kicks in?

Meanwhile, US stocks made fresh highs with both the S&P 500 and NASDAQ making fresh closing highs. The question is how much further can markets rally on the same news and before distribution kicks in following the accumulation that has taken shape of these prior weeks that lead markets higher into the year-end?

Key data events ahead

Looking ahead of the calendar, we have China Dec trade data is due today as well as Dec Consumer Price Index, with consensus 0.3%mth, 2.4%yr overall. "Recall that the Fed judges this series to consistently overstate inflation, so targets the PCE deflator, which was a muted 1.5%yr in Nov, 1.6% on the core rate. Even so, it can still impact on the market," analysts at Westpac argued.

USD/JPY levels

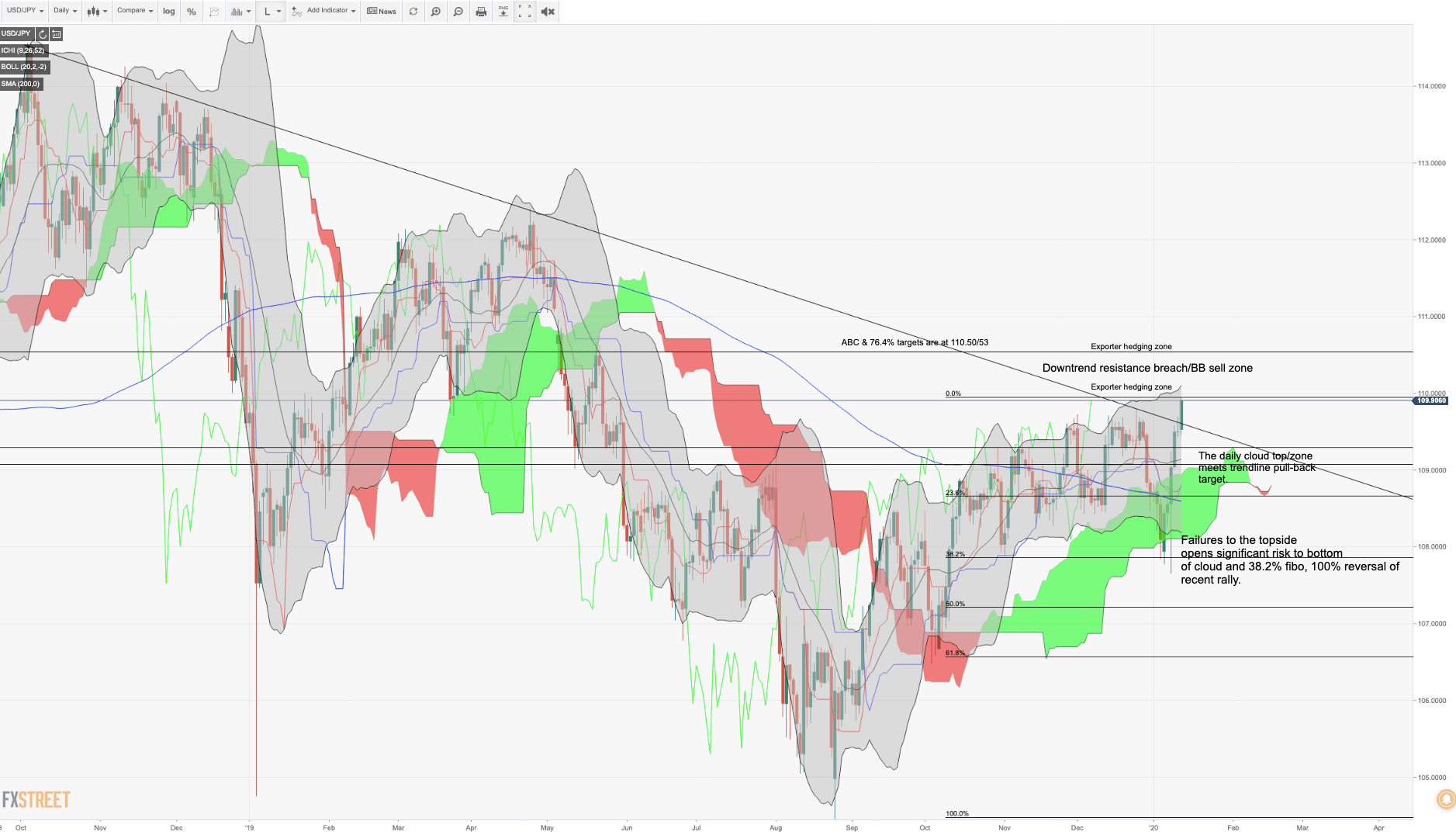

USD/JPY Price Analysis: Pullback to Cloud/Bollinger-Band targets could be in play

- USD/JPY has traded through 109.73 key resistance and the 2018 trendline.

- Price is stalling just ahead of the Bolinger Band (BB) top.

- Bulls looking for a discount could look to the top of daily cloud confluence area.

- Bulls can target 110.50s for confluence resistance target.

- Failures here opens risk to 100% retracement of the recent rally from 107.80s – But, 200-DMA and 23.6% Fibo confluence first critical support target.