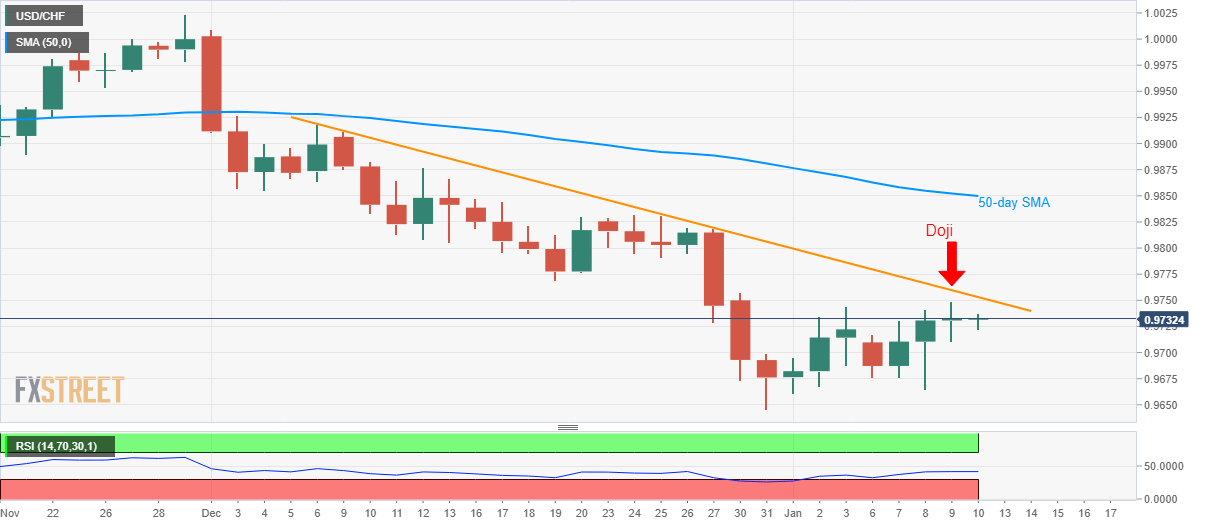

USD/CHF Technical Analysis: Sellers hopeful on Doji formation below monthly trendline

- USD/CHF portrays buyers’ exhaustion despite the absence of losses since Tuesday.

- December month low will be the key to watch.

USD/CHF trades mostly unchanged around 0.9730 while heading into the European session on Friday. The pair formed a Doji candlestick on the daily (D1) chart by Thursday’s end after recovering for the two consecutive prior days.

Considering the candlestick formation indicating the reversal of the previous trend, coupled with the pair’s sustained trading below a downward sloping trend line since December 06, the pair’s further recovery is doubtful.

As a result, sellers will look for entry below Thursday’s low of 0.9711 while targeting 0.9675 and the 2019-end low of 0.9645.

During the quote’s extended downpour beneath 0.9645, 0.9600 and September 2018 low surrounding 0.9550/45 will be the key to watch.

On the upside, pair’s rise beyond 0.9755 trend line resistance will push buyers to aim for a late-December high near 0.9730 and 50-day SMA level of 0.9850 during further advances.

USD/CHF daily chart

Trend: Pullback expected