Our best spreads and conditions

About platform

About platform

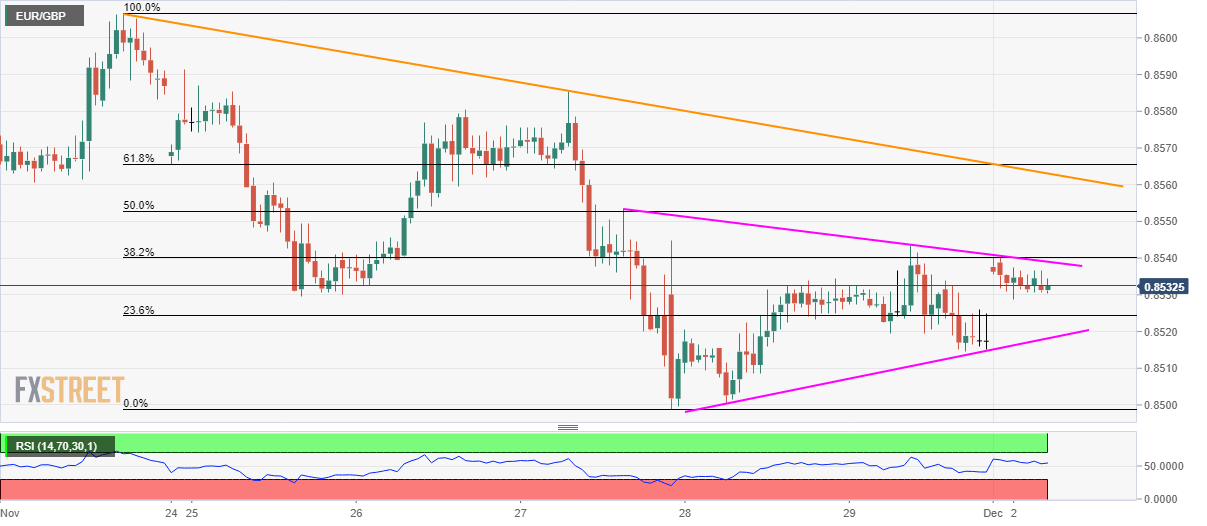

While taking rounds to 0.8530 ahead of Monday’s European session, the EUR/GBP pair maintains a three-day-old symmetrical triangle formation.

The pair now seems to be clubbed between 0.8520 and 0.8540 with another descending trend line since November 22, near 0.8565, providing extra resistance.

Alternatively, pair’s downside below 0.8520 can aim for the last week's low near 0.8500 while lows marked in May and March months, around 0.8490 and 0.8470 respectively, could keep bears happy afterward.

It’s worth mentioning that September 20 low near 0.8785 becomes the key resistance for buyers to watch if all prices manage to cross 0.8565.

Trend: Sideways