Analisa Teknis USD/JPY: Garis Tren Naik 6 Pekan, 108,30 Pada Radar Penjual

- USD/JPY turun ke level terendah delapan hari di tengah perlombaan yang sedang berlangsung untuk keselamatan risiko.

- Beberapa resistensi dan MACD bearish membuat pembeli menjauh.

Meningkatnya protes di Hong Kong dan ketidakpastian seputar kesepakatan perdagangan AS-China menimbulkan tekanan pada pasangan USD/JPY ketika turun ke level terendah beberapa hari sementara diperdagangkan di dekat 108,70 menjelang sesi Eropa hari ini.

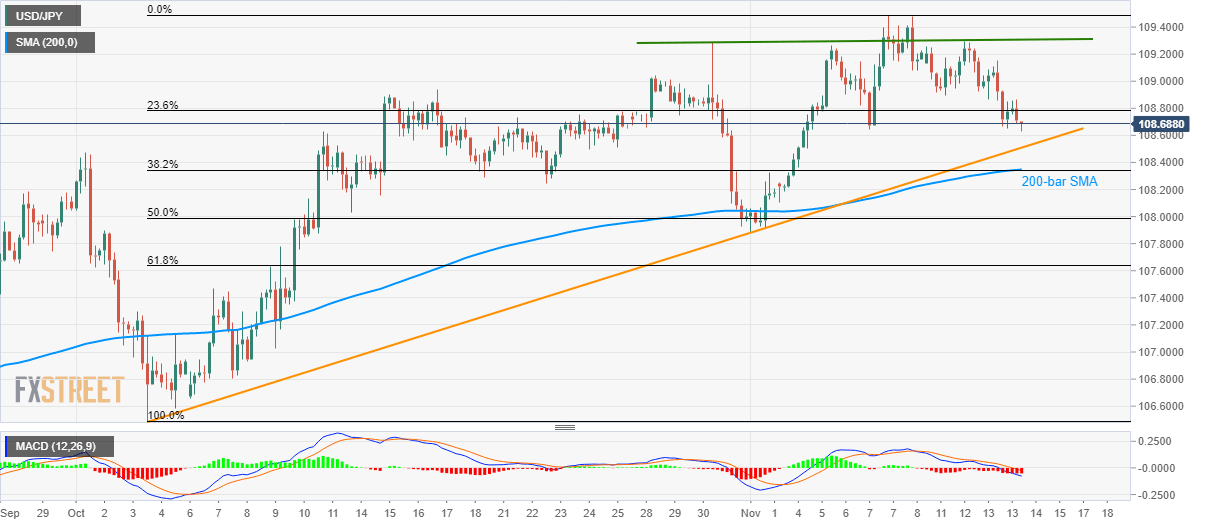

Dengan sinyal bearish dari Moving Average Convergence and Divergence (MACD) 12-bar, harga semakin menurun menuju garis support naik enam pekan, di 108,50 sekarang. Namun, pertemuan 108,30 termasuk Simple Moving Average (SMA) 200-bar dan Fibonacci retracement 38,2% dari gerakan naik Oktober-November akan menantang penjual setelahnya.

Dengan dominasi bear di atas 108,30, penutupan bulanan di dekat 108,00 dan level Fibonacci retracement 61,8% di sekitar 107,60 bisa kembali pada grafik.

Atau, 109,00 bertindak sebagai penghalang sisi atas terdekat sementara jika ditembus bisa mengalihkan perhatian pembeli ke garis horizontal di sekitar 109,30 dan kemudian ke puncak bulanan di dekat 109,50.

Jika naik di atas 109,50, puncak akhir Mei di dekat 110,00 dan 110,70 bisa menjadi favorit utama.

Grafik 4 jam USD/JPY

Tren: Bearish

Tingkat penting tambahan