Back

30 Oct 2019

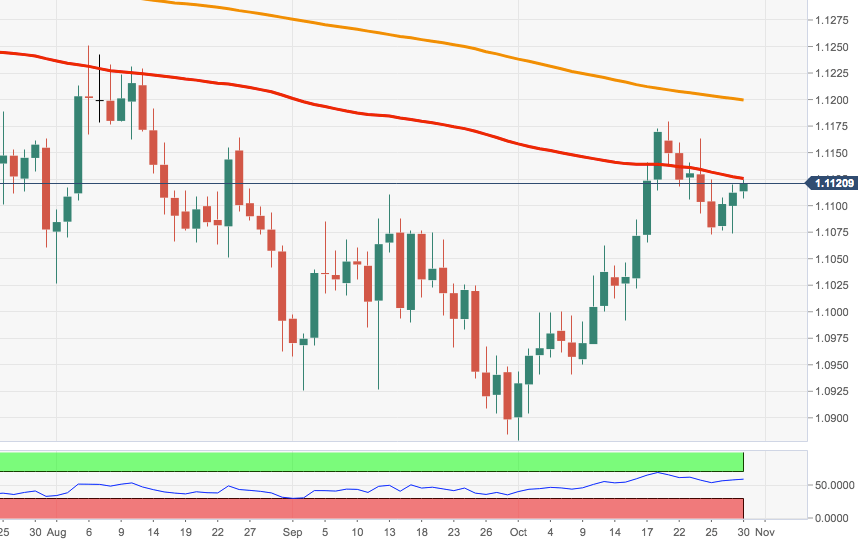

EUR/USD Technical Analysis: A surpass of the 100-day SMA allows for a test of 1.1180

- EUR/USD is prolonging the recovery so far this week and is now testing the key 100-day SMA in the 1.1120 region, coming up from 2-week lows in the 1.1070 region.

- Against this backdrop, last Thursday’s bearish ‘outside day’ has already played its part and the focus now appears to have re-shifted to the upside.

- That said, a move beyond the 100-day SMA should open the door for another visit to monthly peaks near 1.1180 ahead of the more relevant 200-day SMA just below 1.1200 the figure.

EUR/USD daily chart