Back

23 Oct 2019

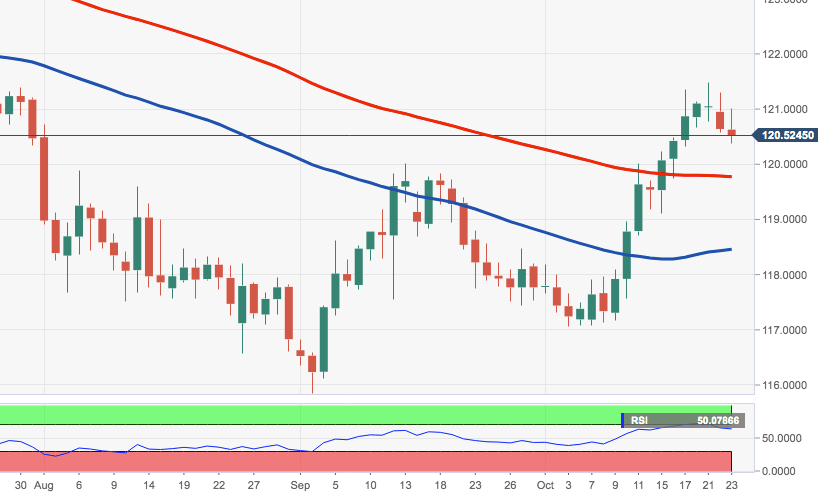

EUR/JPY Technical Analysis: Downside expected to re-test the 100-day SMA near 119.80

- The rally in EUR/JPY appears to have met important resistance in the 121.50 region, coincident with late July peaks. The ongoing correction lower comes along renewed softness in EUR, some pick up in the demand for safe havens and a move away from overbought levels, as measured by the RSI.

- Further selling impulso should meet the next relevant support at the 100-day SMA in the 119.80 region ahead of the 55-day SMA, today at 118.45.

- The resumption of the up move is expected to target the key 200-day SMA at 122.21.

EUR/JPY daily chart