When is the US GDP report and how could it affect EUR/USD?

US Q2 GDP Overview

Friday's US economic docket highlights the release of advance (first estimate) of the US Q2 GDP growth figures, scheduled to be published at 12:30 GMT. The US economy is anticipated to have expanded at an annualized pace of 1.8% during the second quarter of 2019, a significant deceleration from the 3.2% growth recorded in the previous quarter.

Analyst(s) at Danske Bank provided their take on the upcoming release and wrote - “we forecast GDP grew at an annualized rate of 2.3% in Q2 19, led by robust consumer spending and government expenditures. The latter component growth is likely to be derived from a rebound in federal government hours after the negative contribution of the long shutdown in Q1 19.”

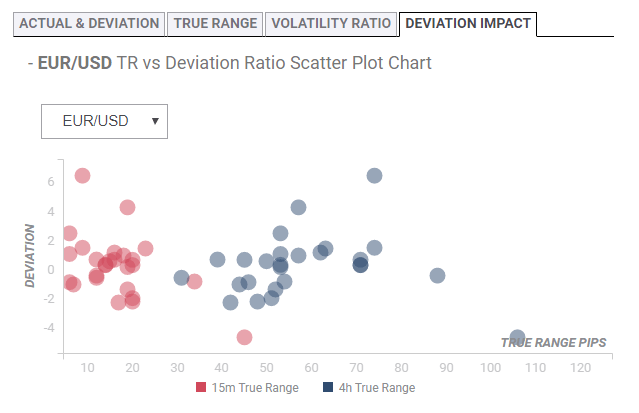

Deviation impact on EUR/USD

Readers can find FX Street's proprietary deviation impact map of the event below. As observed the reaction on the EUR/USD pair, in case of a deviation between -0.88 to +0.68, is likely to be in the range of 27-28 pips in the first 15-minutes and could extend to 72-83 pips in the following 4-hours.

How could it affect EUR/USD?

Ahead of the important release, Yohay Elam, Analyst at FXStreet provides important technical levels to trade the major - “Initial support awaits at 1.1125, which was a low point earlier last week. Thursday's new 2019 low of 1.1101 is critical support. Below, 1.1025 and 1.0900 are the next lines to watch, and they date back to 2017.”

“Some resistance awaits at 1.1155, which held EUR/USD down earlier this week. It is followed by 1.1190, which was the high point on Thursday. Next up, we find 1.1245, which served as both support and resistance earlier in July,” he added further.

Key Notes

• US Second Quarter GDP Preview: The dollar follows growth

• US GDP Preview: Banks expecting slowdown in Q2 GDP numbers

• EUR/USD Forecast: The fall is far from over as US GDP looms

About the US GDP

The Gross Domestic Product Annualized released by the US Bureau of Economic Analysis shows the monetary value of all the goods, services and structures produced within a country in a given period of time. GDP Annualized is a gross measure of market activity because it indicates the pace at which a country's economy is growing or decreasing. Generally speaking, a high reading or a better than expected number is seen as positive for the USD, while a low reading is negative.