Our best spreads and conditions

About platform

About platform

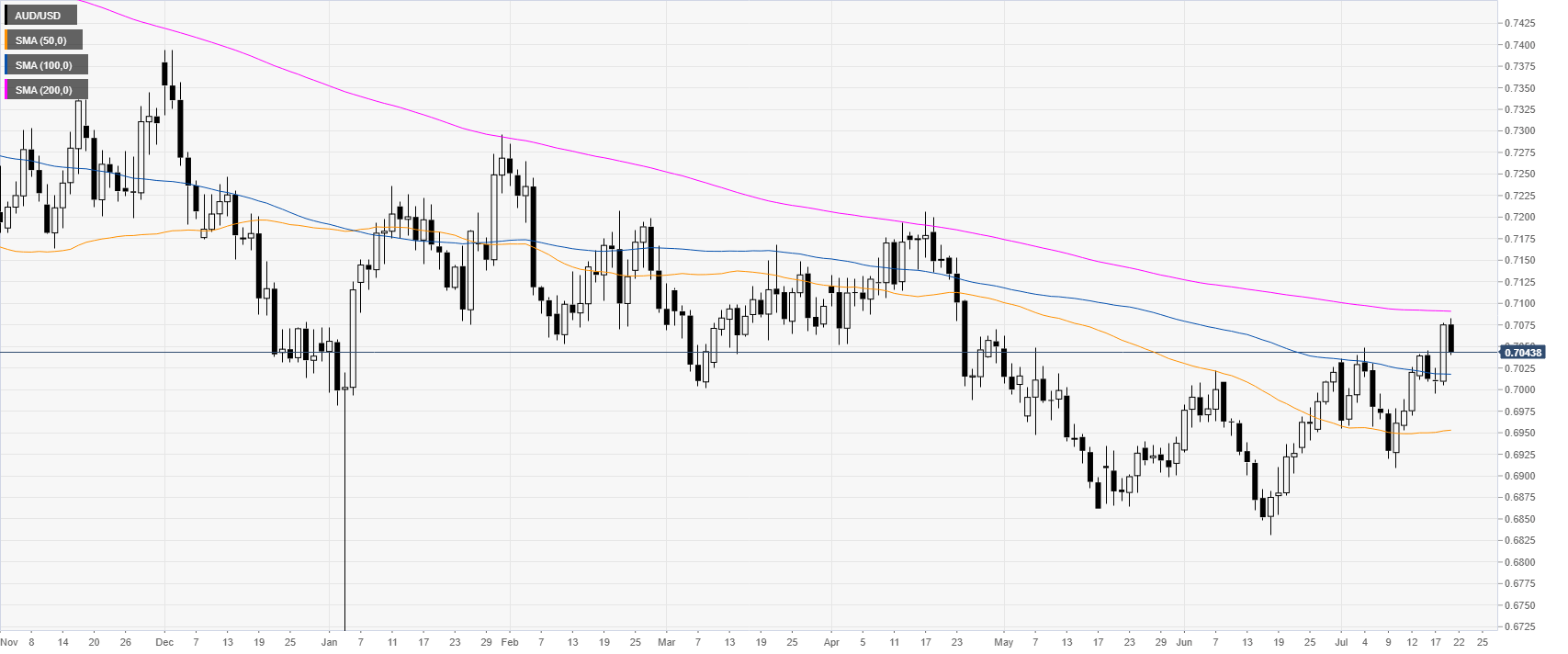

The Aussie is trading in a bear trend below the 0.7000 handle and the 200-day simple moving average (DSMA).

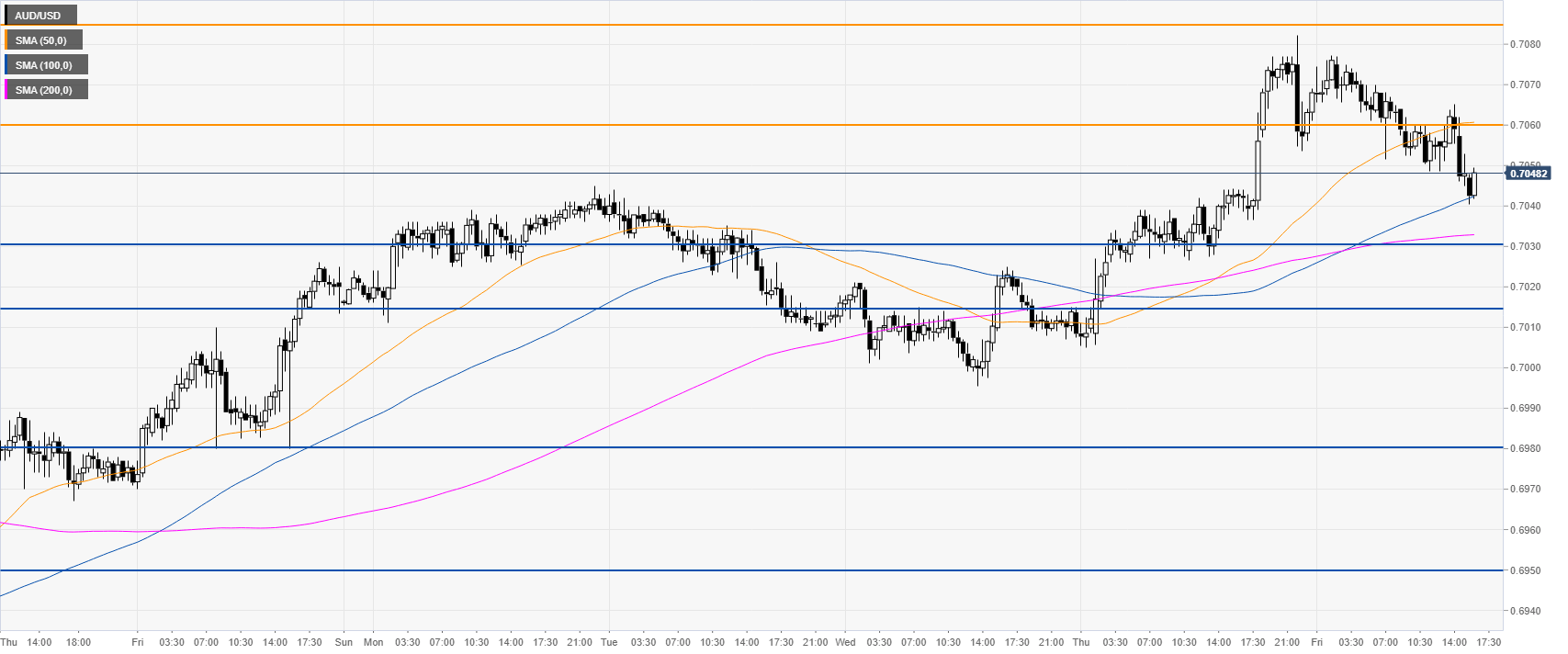

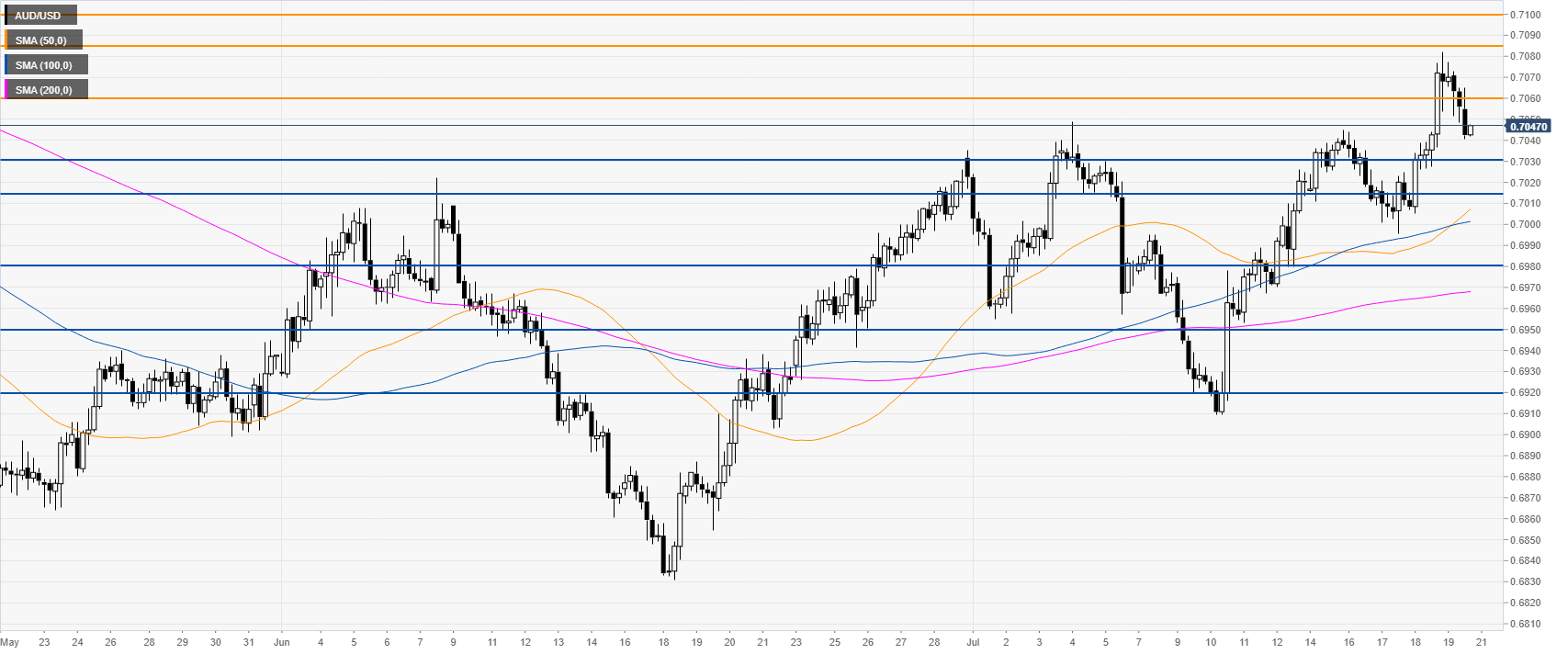

AUD/USD is pulling back down as the market is trading above its main SMAs. Bulls are losing steam as they need to reclaim the 0.7060 resistance in order to reach the 0.7100 handle.

AUD/USD is trading at daily lows as the market is testing the 100 SMA near 0.7040. The market is correcting down and a break through 0.7040 can lead to 0.7030 and 0.7015 support, according to the Technical Confluences Indicator.