Back

21 Jun 2019

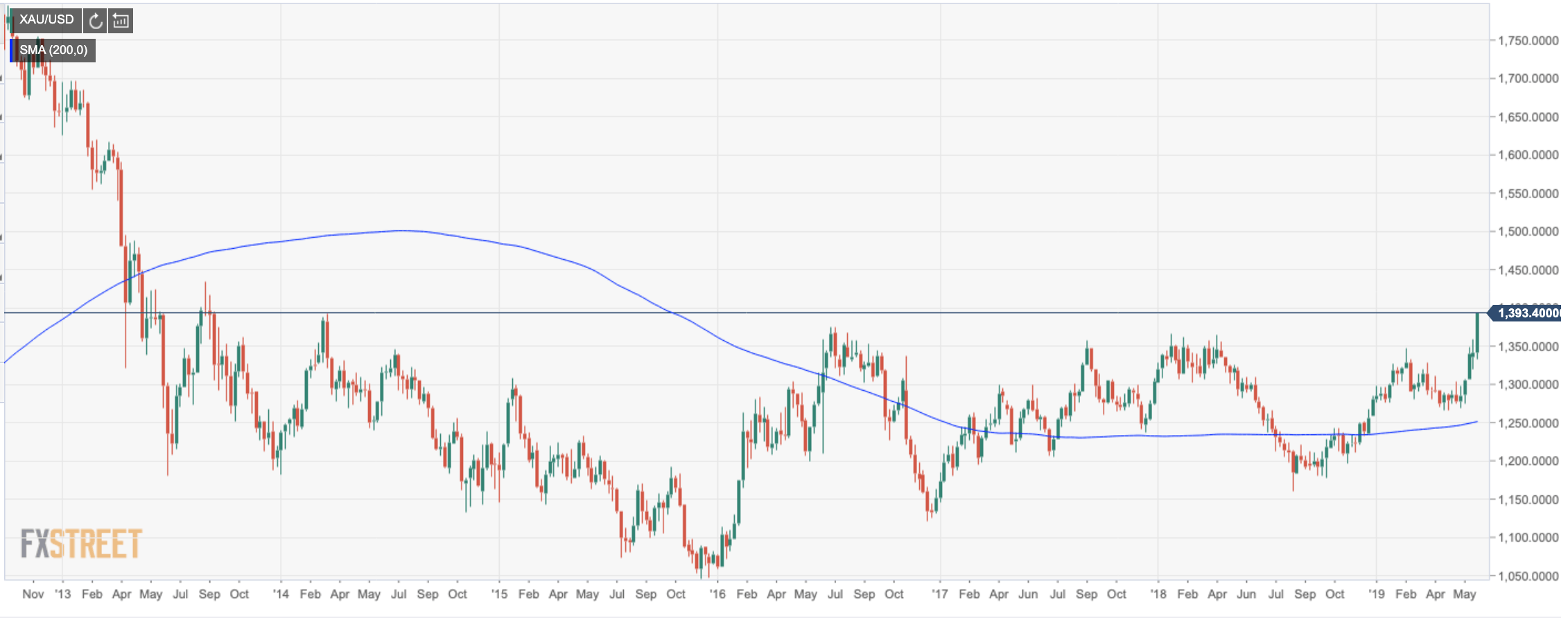

Gold levels shoot into unchartered waters, bulls eye $1400s

- Gold levels shoot into unchartered waters, with the case for a pullback on the table.

- On a continuation of the upside, 1416 comes in as the Sep' 2013 highs.

Technically, yesterday, the price of gold just kept going well beyond the daily Average True Range. However, the upside might be done for now while the price moves into a consolidation on the lower time frames, printing the usual correction candles. On the 4-hour charts, we have a hanging man, and on the 1-hour chart, we have a spinning top as sellers emerge. However, the daily price action remains bullish although 1376 comes in as a 50% mean reversion target on the downside of the overnight daily stick. On a continuation of the upside, 1416 comes in as the Sep' 2013 highs while 1433 comes in as the Aug' 2013 highs.