Our best spreads and conditions

About platform

About platform

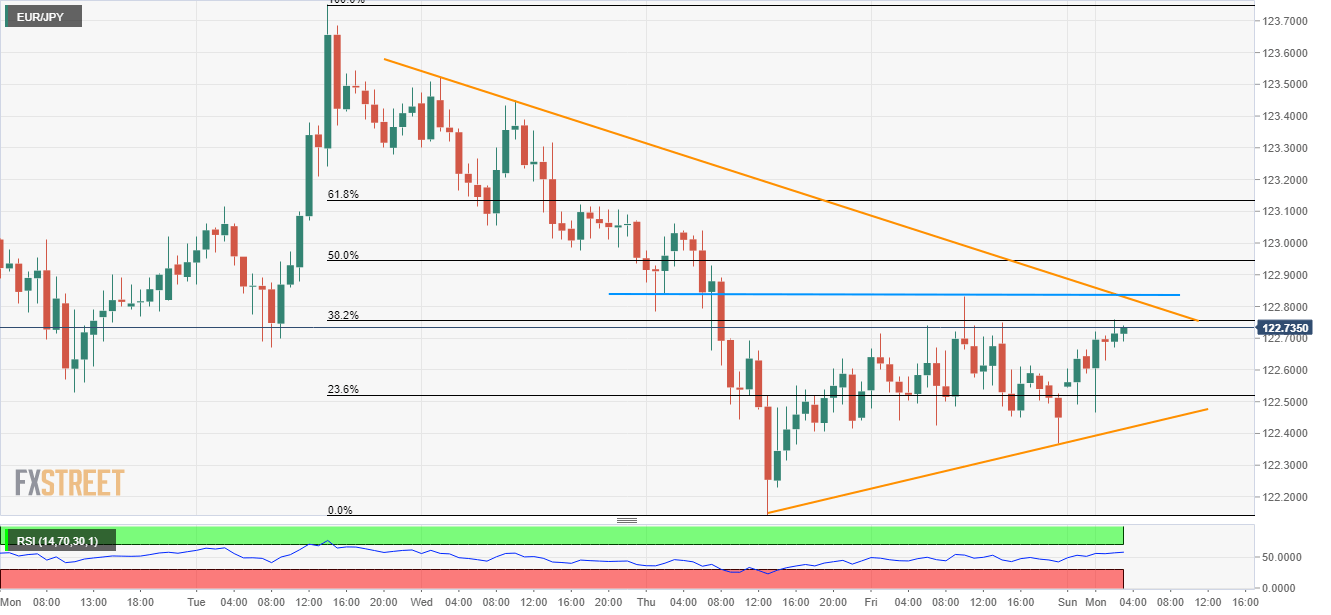

Despite being on the bids around 122.75 during early Monday, the EUR/JPY pair is likely finding hard to extend the latest advances.

The reason being 122.85 resistance-confluence that comprises of near-term descending and horizontal trend-lines.

Should there be additional upside past-122.85, pair’s rise to 61.8% Fibonacci retracement level near 123.15 can’t be denied.

If at all bulls continue dominating trade sentiment above 123.15, 123.55 and the latest high near 123.75 could be of importance to watch.

Meanwhile, 122.60 and immediate upward sloping trend-line at 122.40 may limit the quote’s nearby declines.

In a case where prices slip under 122.40, 122.25 and 122.00 might come back on the chart.

Trend: Bearish