Back

25 Apr 2019

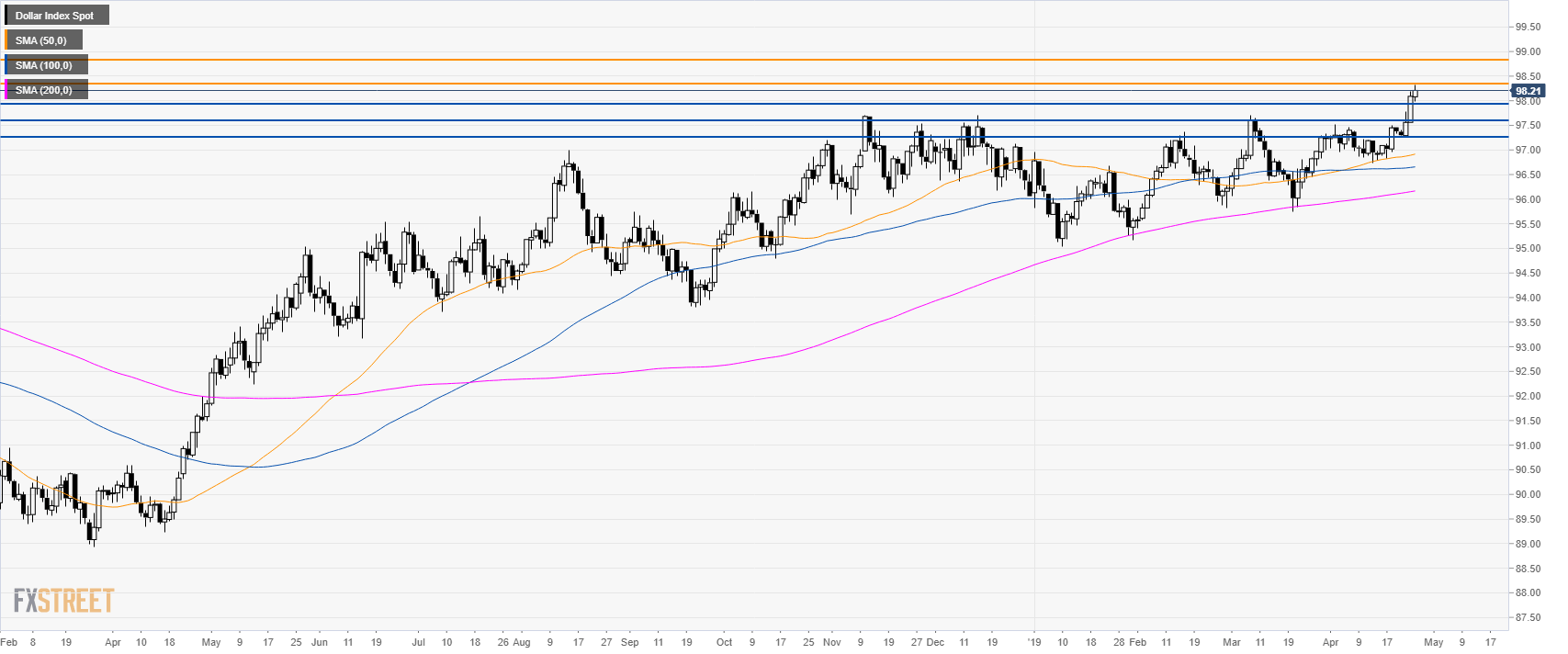

Dollar Index Technical Analysis: DXY looks to extend gains above 98.40 resistance

DXY daily chart

- The US Dollar Index (DXY) is trading in a bull trend above its main simple moving average (SMAs).

- DXY is trading at multi-month highs after breaking key resistance at 97.71 level.

DXY 4-hour chart

- The momentum is bullish as the index trades above its main SMAs.

- The level to beat for bulls is 97.40. A break above the level can lead to 98.80 resistance.

- To the downside, support is at 97.90 and 97.60 price level.

Additional key levels