Our best spreads and conditions

About platform

About platform

The optimism around the shared currency stays unchanged so far on Monday and is now taking EUR/USD to fresh daily highs in the mid-1.1200s.

EUR/USD higher on better risk-on mood

Spot is trading on a positive mood so far today and is reversing at the same time three consecutive weekly pullbacks after being rejected from late March tops in the mid-1.1400s.

Today’s upside momentum remains propped up by improved sentiment surrounding the riskier assets and the selling bias hurting the greenback.

In fact, the likeliness of extra stimulus in the Chinese economy, positive data from the US calendar last Friday and persistent downside pressure around the buck have all combined to push the pair to the 1.1250 region, challenging at the same time last week’s peaks.

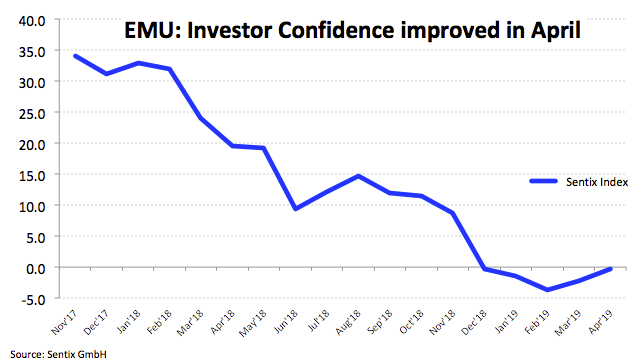

In the data space, the Sentix Index advanced to -0.3 for the current month, also helping the mood around the shared currency. Later in the session, US Factory Orders are due.

What to look for around EUR

EUR remains under pressure following poor fundamentals in Euroland and the strong up move in the greenback in past weeks. In fact, recent disappointing readings in the region somehow confirm that the slowdown in the bloc and the ‘patient-for-longer’ stance from the ECB could be among us for longer than expected. Against the backdrop of souring risk-appetite trend, the greenback should emerge stronger and is expected to keep weighing on spot for the time being. On the political front, headwinds are expected to emerge in light of the upcoming EU parliamentary elections, where the focus of attention will be on the potential increase of the populist option among voters.

EUR/USD levels to watch

At the moment, the pair is gaining 0.29% at 1.1246 and a breakout of 1.1254 (high Apr.1) would target 1.1277 (21-day SMA) en route to 1.1337 (200-week SMA). On the downside, immediate support emerges at 1.1183 (low Apr.2) followed by 1.1176 (low Mar.7) and finally 1.1118 (monthly low Jun.20 2017).