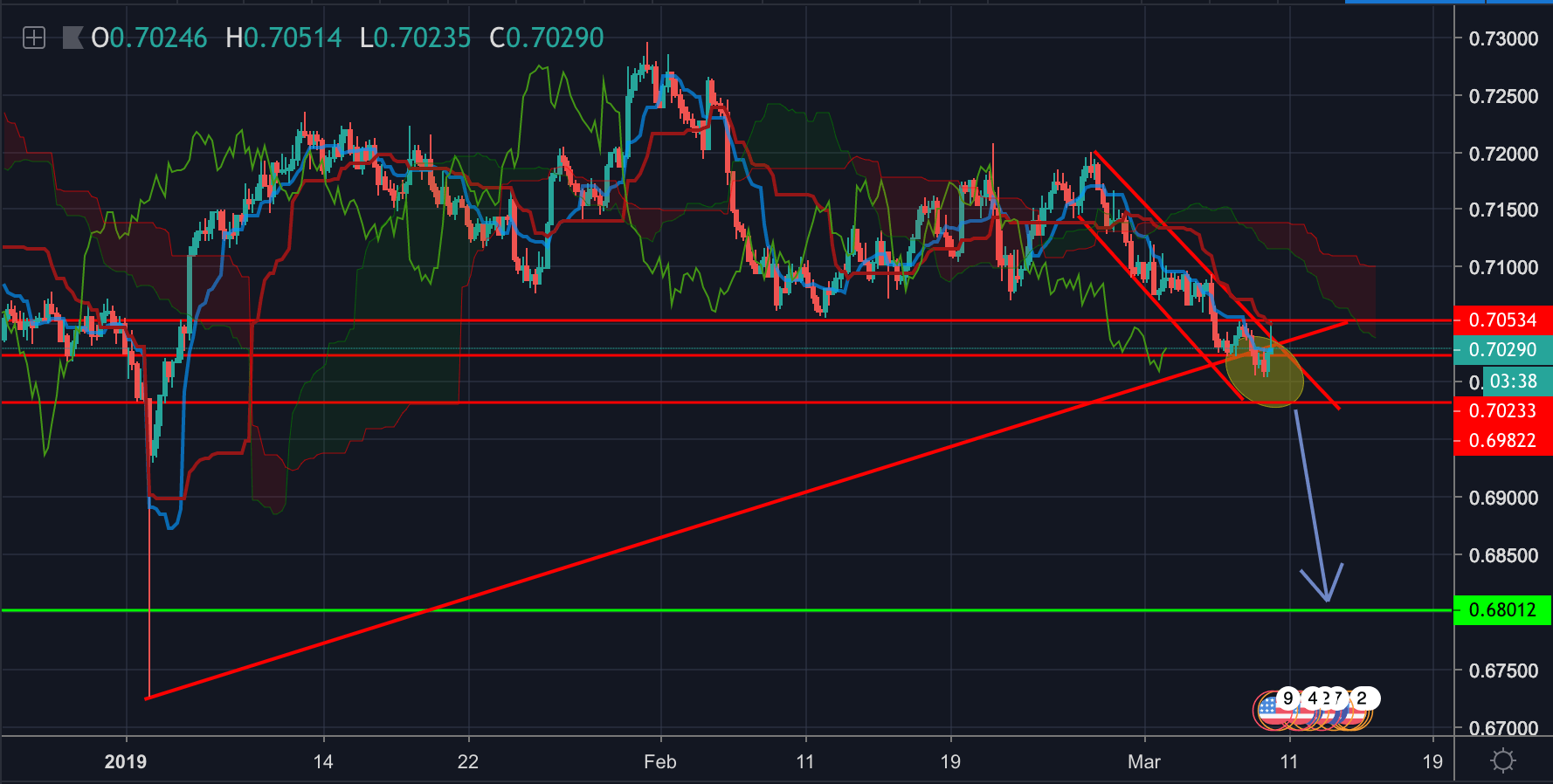

AUD/USD pops and drops on nonfarm payrolls miss, but bets are still for a break below 0.70 handle

- AUD/USD was shot down again at the channel and horizontal resistance at 0.7050 with bets still placed for a break of the 0.70 handle to the downside, targetting 0.68 the figure.

- GDP still gives plenty to worry about for the RBA.

- AUD/USD is currently trading at 0.7030, just about keeping its head above water on the nonfarm payrolls miss.

AUD/USD popped on the release of the headline miss from 0.7027 to a high of 0.7050 before being faded on detail in the data that are still rather solid. There remains a strong downside case in AUD/USD on a fundamental and techncial basis at this juncture and the bears are staying with the offers within the descending channel.

The nonfarm payrolls data arrived as follows:

20k vs 180k headline - This is the worst since Sept 2017. the prior was 304K and revised to +311K. However, not all is bad in the detail of the report.

- Two month net revision +12K

- Unemployment rate 3.8% vs 3.9% expected

- Participation rate 63.2% vs 63.2% prior

- Avg hourly earnings +0.4% vs +0.3% exp

- Avg hourly earnings 3.4% y/y vs +3.3% exp

- Private payrolls +25K vs +170K exp

- Manufacturing +4K vs +12K exp

- U6 underemployment 7.3% vs 8.1% prio

The DXY dropped from 97.40s to a low of 97.25 so far - But not all is bad in that report:

- Participation rate 63.2% vs 63.2% prior

- Avg hourly earnings +0.4% vs +0.3% exp

- Avg hourly earnings 3.4% y/y vs +3.3% exp

For the Aussie, the focus has been on the RBA’s lower growth forecasts and its shift in underlying policy bias from an eventual hike to risks on the cash rate being more evenly balanced.

GDP gave plenty to worry about for the RBA:

"After a strong H1 2018, the Australian economy slowed sharply in H2, to be up just 2.3%yr. There was also considerable (and justifiable) media attention on the consecutive quarters of contraction in GDP per person.So while headline growth was close to consensus, there was plenty to worry about, including for the RBA which said after this week’s Board meeting that its “central scenario is still for the Australian economy to grow by around 3 per cent this year,” analysts at Westpac explained, adding","After the GDP report, some other forecasters joined in the rate cut chorus and interest rate markets scrambled to fully price in a rate cut by November, with a 50% chance of another by early 2020.

AUD/USD levels

AUD/USD had popped up to a key resistance area at 0.7050 (23.6% Fibo) and back out of highly negative territory below 0.7020. However, this could be a better entry level for shorting and the price has been faded at this key resistance. A break of 0.70 the figure exposes 0.6980 as last major defence for a run down to 0.68 the figure.

AUD/USD 4HR chart