Oil Technical Analysis: WTI jumps above $57.00 a barrel

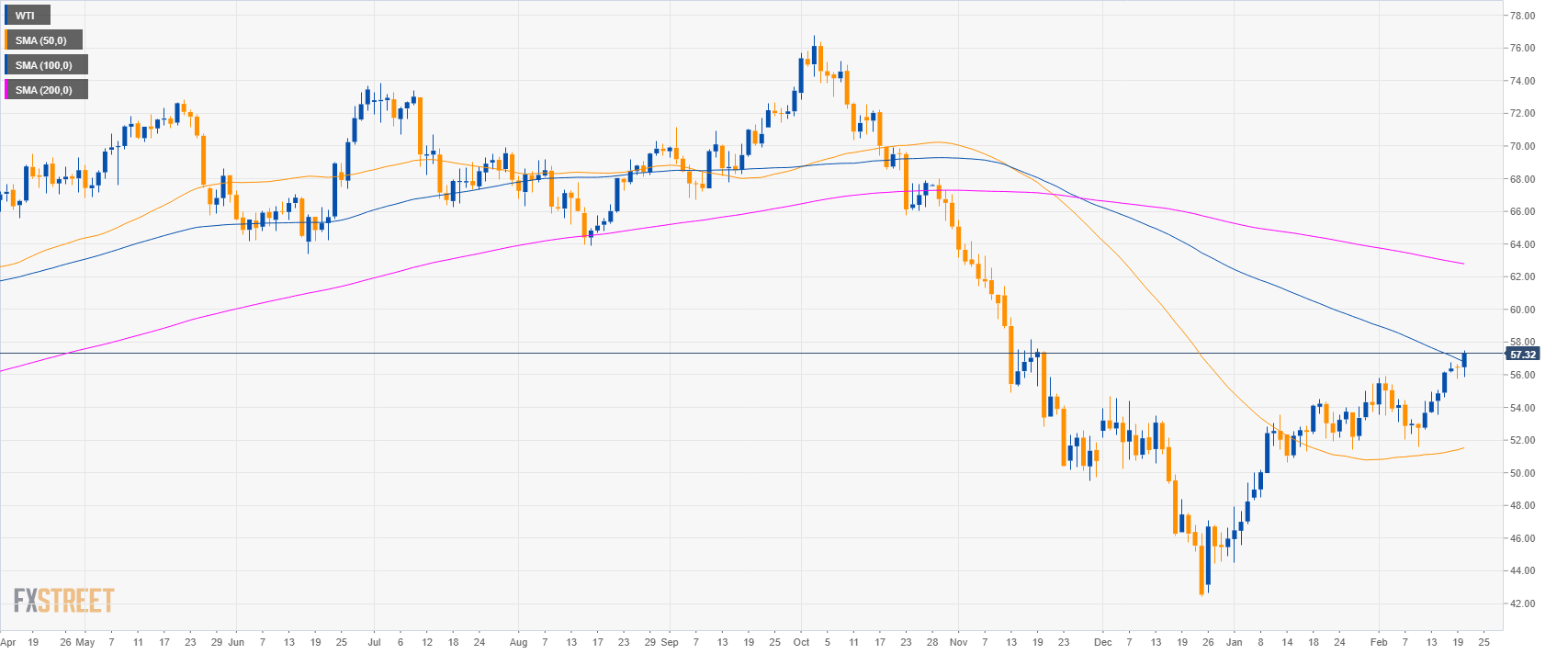

Oil daily chart

- Crude oil WTI is breaking above the 100 SMA suggesting that bulls are getting stronger.

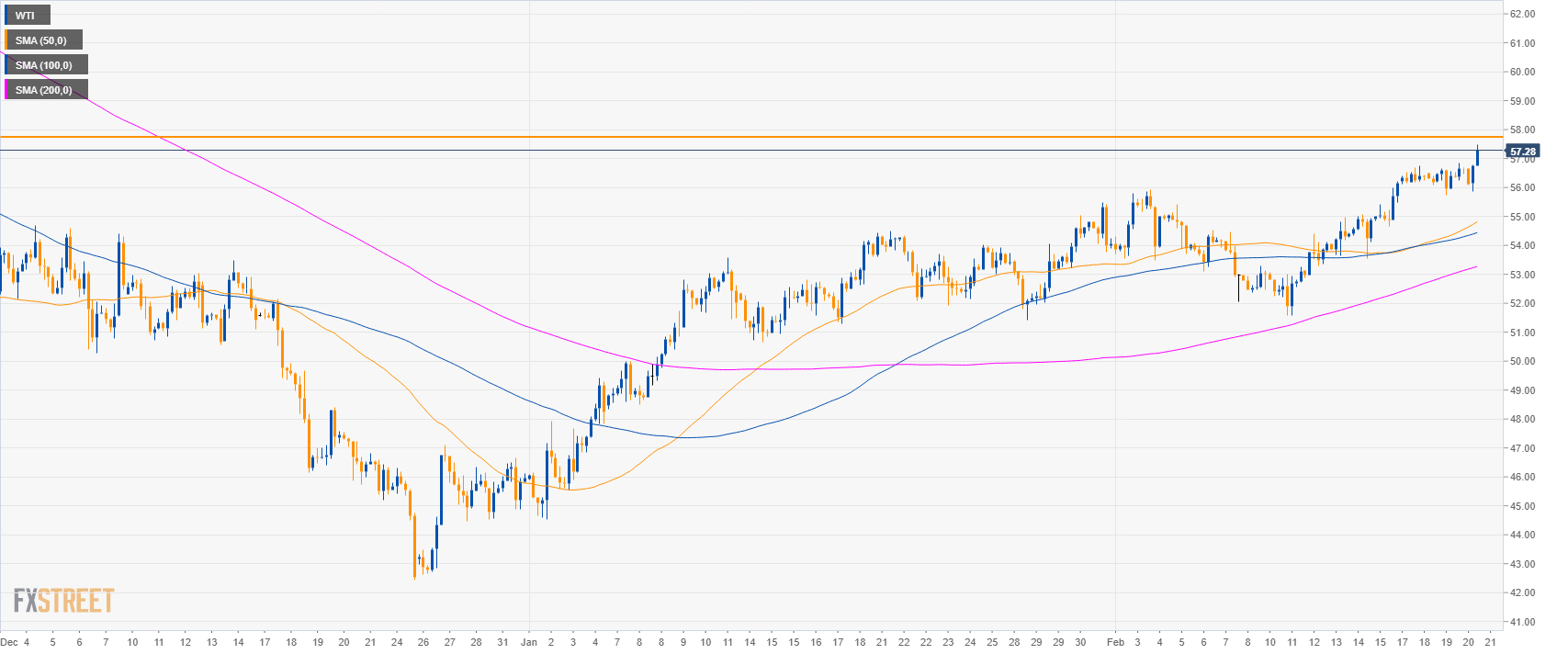

Oil 4-hour chart

- Crude oil is trading above the main SMAs suggesting bullish momentum in the medium-term.

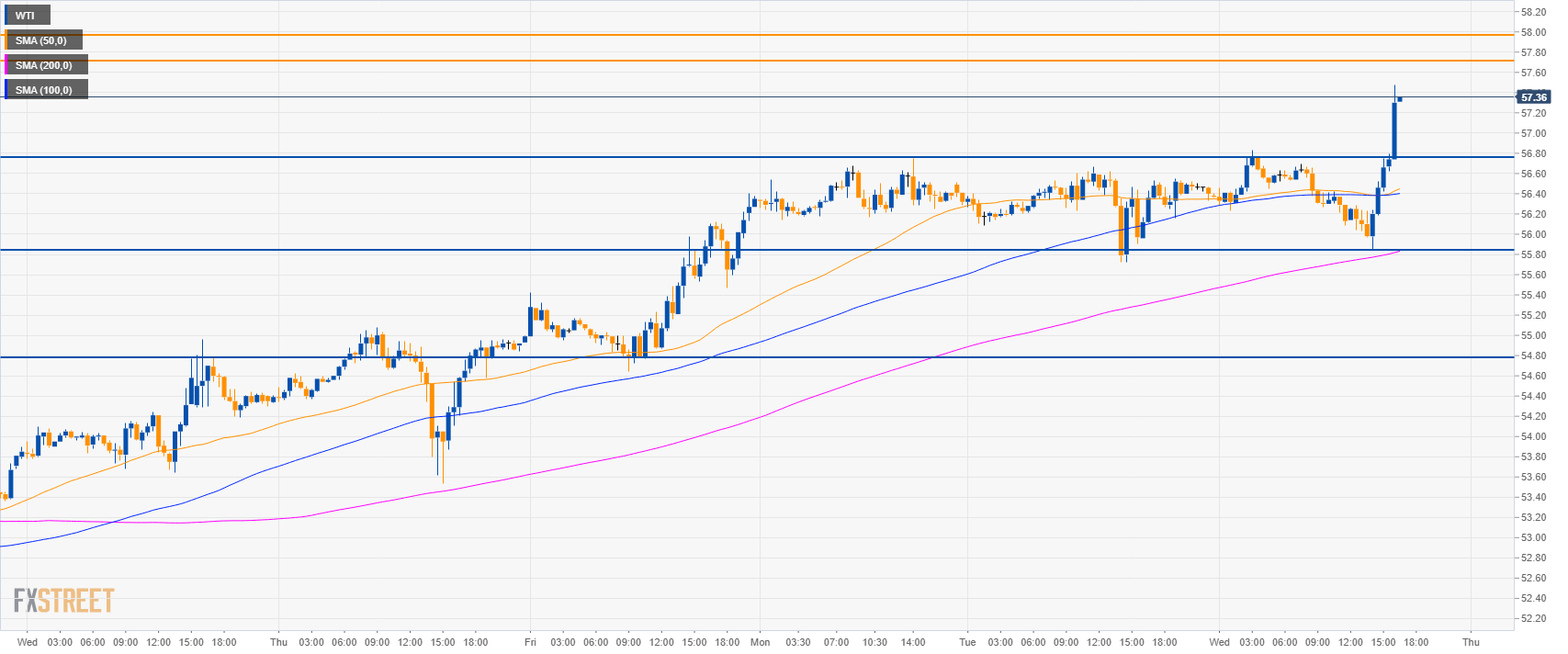

Oil 30-minute chart

- WTI is trading above its main SMAs suggesting bullish momentum in the short-term.

- The next bullish target is at 57.70 and $58.00 a barrel.

- Support is seen at 56.80 and 55.80 level.

Additional key levels

WTI

Overview:

Today Last Price: 57.3

Today Daily change: 83 ticks

Today Daily change %: 1.47%

Today Daily Open: 56.47

Trends:

Daily SMA20: 54.13

Daily SMA50: 51.42

Daily SMA100: 55.59

Daily SMA200: 62.77

Levels:

Previous Daily High: 56.67

Previous Daily Low: 55.72

Previous Weekly High: 56.22

Previous Weekly Low: 51.56

Previous Monthly High: 55.48

Previous Monthly Low: 44.52

Daily Fibonacci 38.2%: 56.08

Daily Fibonacci 61.8%: 56.31

Daily Pivot Point S1: 55.9

Daily Pivot Point S2: 55.34

Daily Pivot Point S3: 54.95

Daily Pivot Point R1: 56.85

Daily Pivot Point R2: 57.24

Daily Pivot Point R3: 57.8