Our best spreads and conditions

About platform

About platform

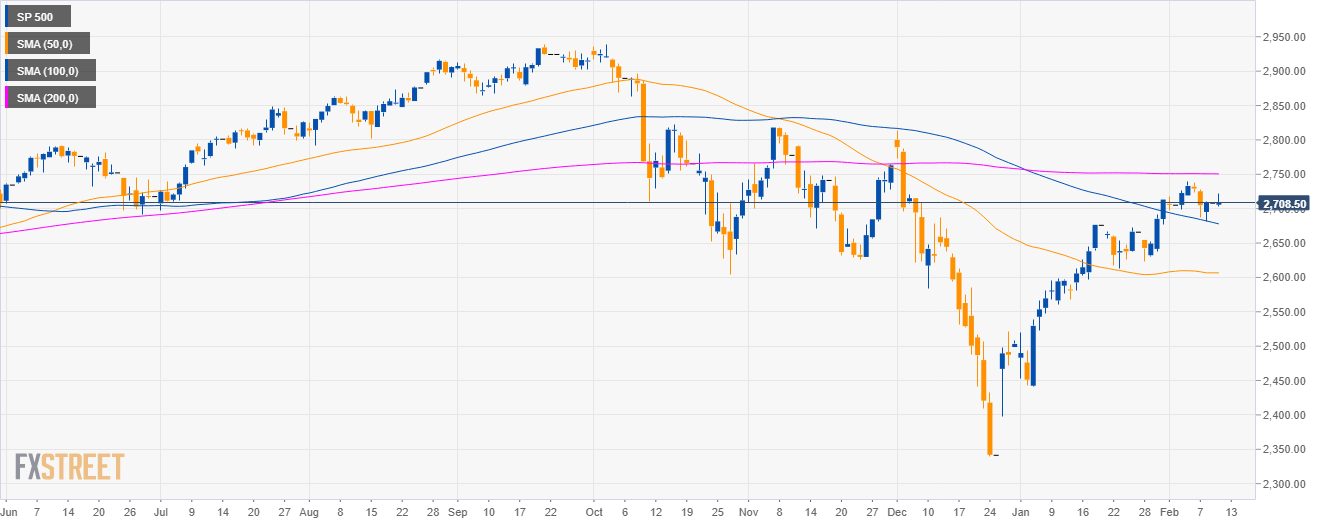

S&P500 daily chart

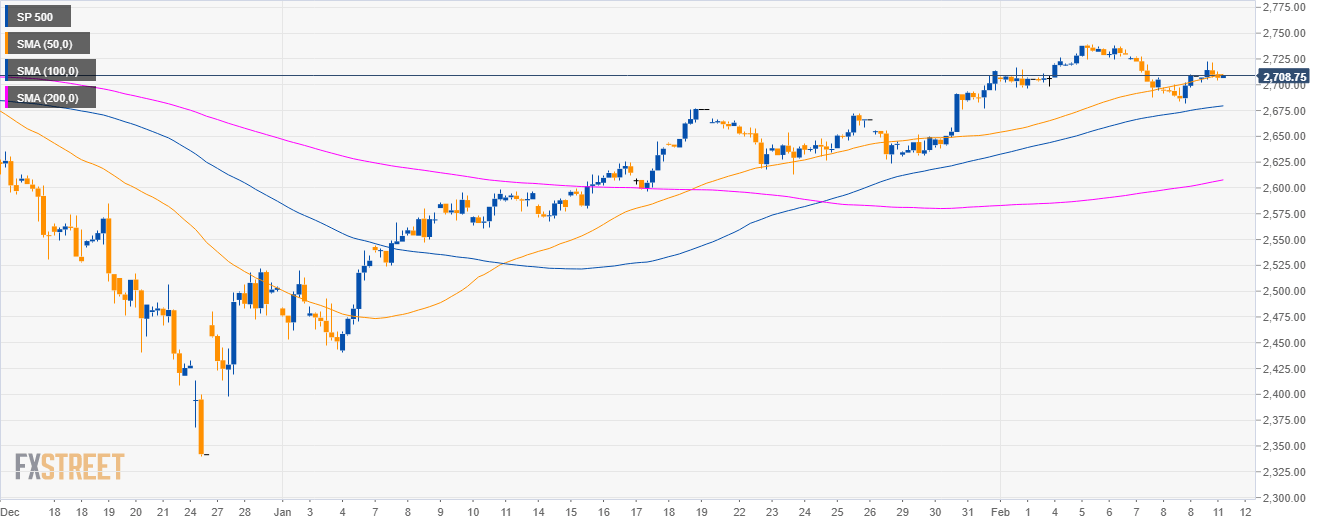

S&P500 4-hour chart

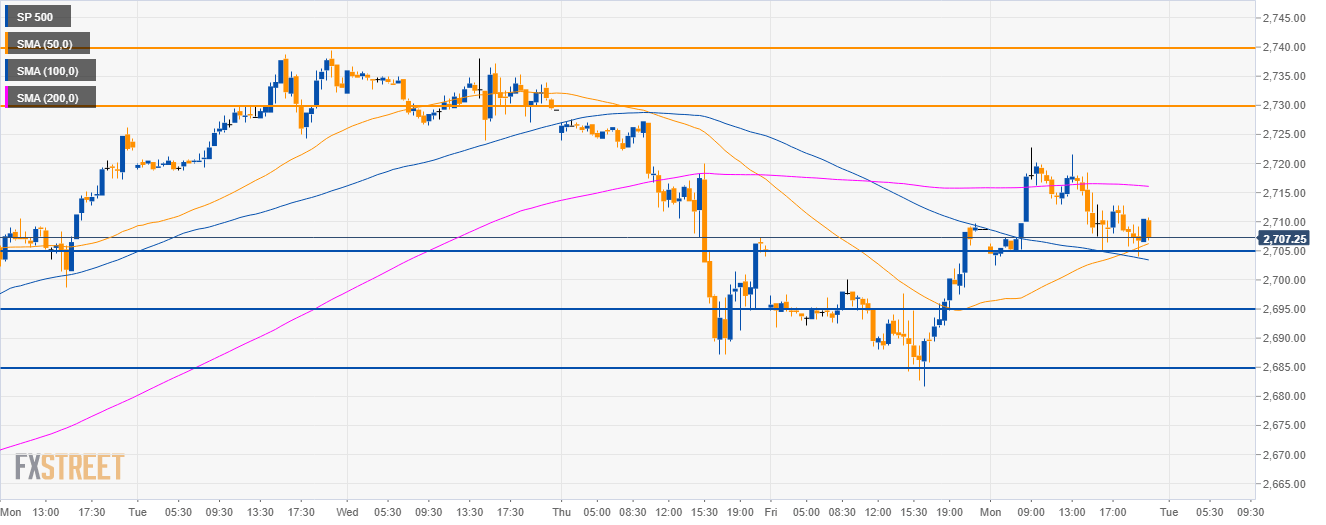

S&P500 30-minute chart

Additional key levels

SP 500

Overview:

Today Last Price: 2710.5

Today Daily change %: 0.06%

Today Daily Open: 2708.75

Trends:

Daily SMA20: 2683.38

Daily SMA50: 2606.74

Daily SMA100: 2680

Daily SMA200: 2750.66

Levels:

Previous Daily High: 2708.75

Previous Daily Low: 2708.75

Previous Weekly High: 2739.5

Previous Weekly Low: 2681.75

Previous Monthly High: 2714

Previous Monthly Low: 2441

Daily Fibonacci 38.2%: 2708.75

Daily Fibonacci 61.8%: 2708.75

Daily Pivot Point S1: 2708.75

Daily Pivot Point S2: 2708.75

Daily Pivot Point S3: 2708.75

Daily Pivot Point R1: 2708.75

Daily Pivot Point R2: 2708.75

Daily Pivot Point R3: 2708.75