AUD/USD Technical Analysis: Aussie hugs 0.7100 figure post-RBA inspired bloodbath

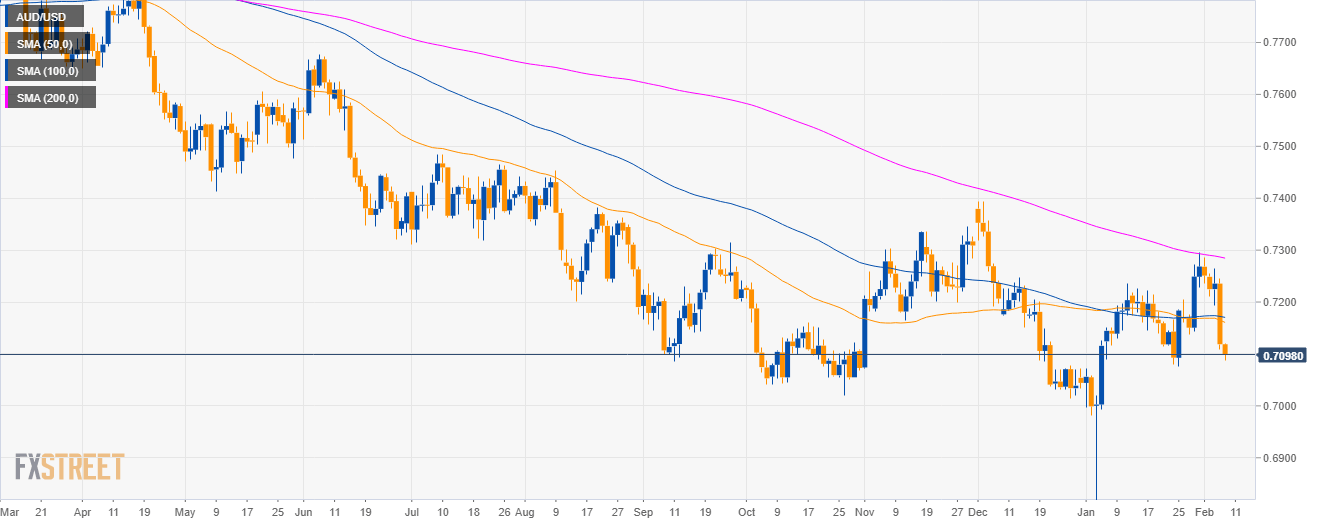

AUD/USD daily chart

- AUD/USD is trading in a bear trend below the 200-day simple moving average (SMA).

- Back on Wednesday, Reserve Bank of Australia's Lowe shifted the forward guidance to neutral and hinted at cutting rates and the AUD dropped more than a 100 pips.

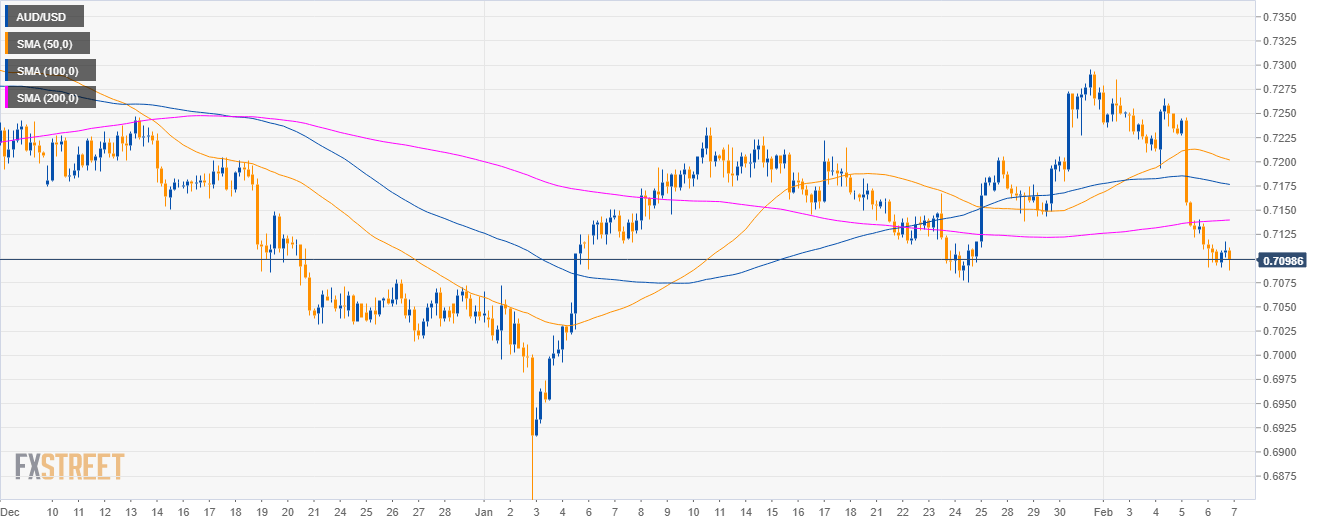

AUD/USD 4-hour chart

- AUD/USD is trading below its main SMAs suggesting bearish momentum in the medium-term.

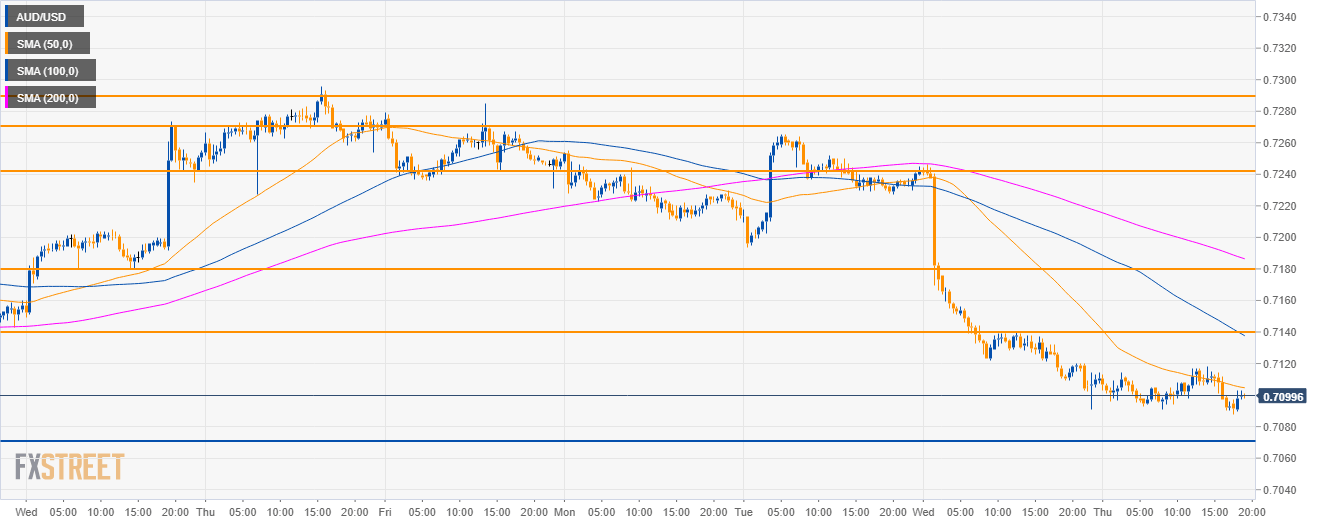

AUD/USD 30-minute chart

- Aussie is trading below its main SMAs suggesting bearish momentum in the short-term.

- Bears will need to overcome the 0.7070 support in order to travel to 0.7000 figure to the downside.

- On the flip side, resistances are seen near 0.7140 and 0.7180 level.

Additional key levels

AUD/USD

Overview:

Today Last Price: 0.71

Today Daily change: -19 pips

Today Daily change %: -0.27%

Today Daily Open: 0.7119

Trends:

Daily SMA20: 0.7184

Daily SMA50: 0.7165

Daily SMA100: 0.7172

Daily SMA200: 0.7287

Levels:

Previous Daily High: 0.7246

Previous Daily Low: 0.7109

Previous Weekly High: 0.7296

Previous Weekly Low: 0.7138

Previous Monthly High: 0.7296

Previous Monthly Low: 0.6684

Daily Fibonacci 38.2%: 0.7161

Daily Fibonacci 61.8%: 0.7194

Daily Pivot Point S1: 0.707

Daily Pivot Point S2: 0.7021

Daily Pivot Point S3: 0.6933

Daily Pivot Point R1: 0.7207

Daily Pivot Point R2: 0.7295

Daily Pivot Point R3: 0.7344