US Dollar Index firmer, tests highs near 95.90

- The index is extending the up move to the vicinity of 96.00.

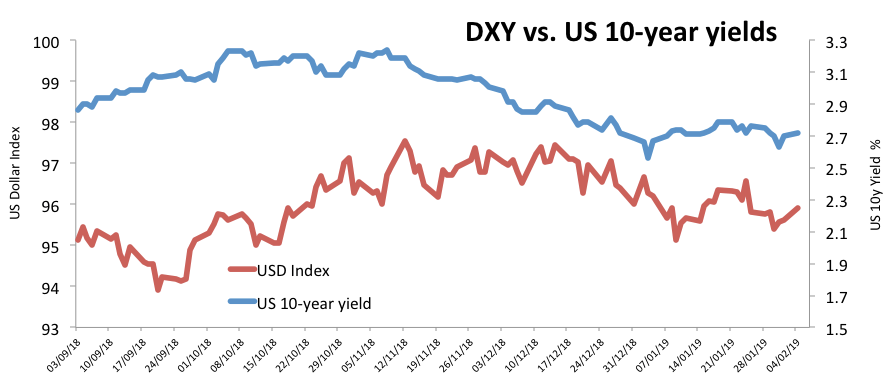

- Yields of the US 10-year note trade in 3-day highs.

- US Factory Orders next on tap ahead of ISM Non-manufacturing (Tuesday).

The greenback is prolonging the upside today, pushing the US Dollar Index (DXY) to fresh 3-day highs near the 95.90 area.

US Dollar Index up on USD/JPY selling

The index is gaining ground since last Thursday’s lows in the 95.20/15 band, where also converges the critical 200-day SMA and a Fibo retracement of the September-December up move.

Today’s advance comes in tandem with a strong rebound in yields of the US 10-year note, which are now navigating 3-day highs above 2.71%.

Later in the US docket, Factory Orders for the month of November are due ahead of tomorrow’s more relevant ISM Non-manufacturing.

What to look for around USD

The greenback appears to have left behind the recent dovish message from the FOMC at its last meeting. However, investors are expected to remain vigilant on the new neutral stance from the Federal Reserve, as well as any indication of the timing of the balance sheet run-off. In addition, President Trump and China’s Xi Jinping will meet again later in the month amidst the recent improvement in the sentiment surrounding these negotiations.

US Dollar Index relevant levels

At the moment, the pair is up 0.30% at 95.90 and a breakout of 96.16 (100-day SMA) would open the door to 96.22 (38.2% Fibo of the September-December up move) and finally 96.45 (55-day SMA). On the downside, immediate contention emerges at 95.33 (200-day SMA) followed by 95.16 (low Jan.31) and then 95.03 (2019 low Jan.10).