USD/JPY moves to 2019 tops beyond 110.00

- Higher US yields push the pair beyond the 110.00 handle.

- Spot prints new yearly highs near 110.10.

- US Factory Orders will be the sole release in the calendar.

Increasing selling pressure around the Japanese currency is now lifting USD/JPY to fresh YTD tops above 110.00 the figure.

USD/JPY bolstered by yields

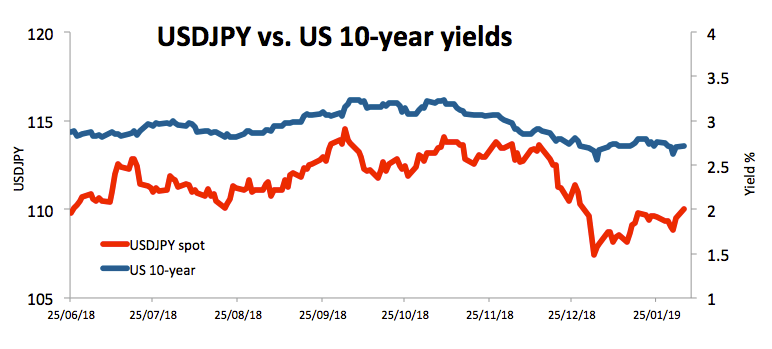

Spot returned to levels last seen in late December beyond the critical 110.00 milestone on the back of rising yields in US money markets.

In fact, yields of the key US 10-year note are navigating multi-day tops beyond 2.71%, as opposed to the sideline theme prevailing in yields of the Japanese 10-year reference.

Additionally, the recent progress in the US-China trade dispute have been also sustaining some optimism in the risk-associated complex, all in detriment of the Japanese safe haven.

In the data space, today’s US docket will only see November’s Factory Orders ahead of tomorrow’s key ISM Non-manufacturing.

USD/JPY levels to consider

As of writing the pair is up 0.48% at 110.05 and faces the next hurdle at 110.09 (2019 high Feb.4) followed by 111.24 (200-day SMA) and then 111.40 (high Dec.26 2018). On the other hand, a breach of 109.43 (10-day SMA) would aim for 109.11 (21-day SMA) and then 108.49 (low Jan.31).