When is the UK construction PMI and how could it affect GBP/USD?

The UK construction PMI overview

The UK construction PMI for January is due for release today at 0930GMT, with the figure expected to come in at 52.6, down from December’s 52.8 reading.

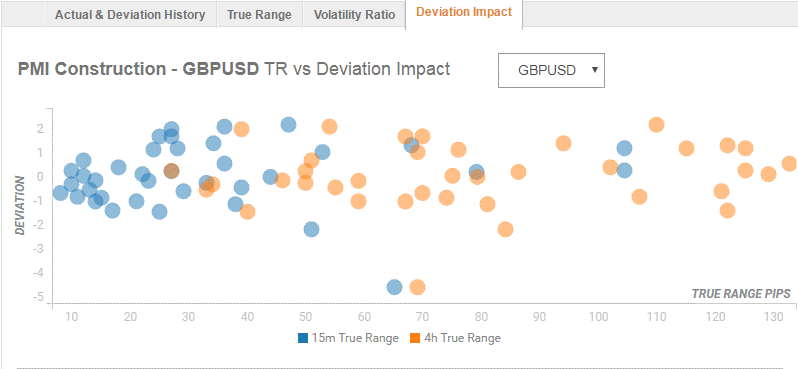

Deviation impact on GBP/USD

Readers can find FX Street's proprietary deviation impact map of the event below. As observed the reaction is likely to remain confined between 10 and 45 pips in deviations up to 2 to -2, although in some cases, if notable enough, a deviation can fuel movements of up to 70 pips.

How could affect GBP/USD?

Technically, the pair looks to extend its consolidative mode near 1.3070 levels. On a positive surprise, a break higher towards the 1.31 handle cannot be ruled out. A sustained move above the last could see a test of 1.3116 inevitable (10-DMA). On the flip side, a break below 1.3050 (psychological levels), GBP/USD could retest 1.3013 (20-DMA) en route 1.2958 (200-DMA).

A dismal UK construction PMI report cannot be ruled today, given Monday’s downbeat manufacturing PMI numbers. The construction PMI has widely shown the similar behavior as the manufacturing and services PMIs, analysts Societe Generale pointed out in a research note. However, the reaction in the GBP is more likely to be driven by the Brexit-related headlines amid ongoing standoff around the Irish border backstop.

Key Notes

Market themes of the Day: The year of the Pig sees US Dollar stronger after strong NFP

GBP/USD Forecast: Irish backstop stalemate to keep the British Pound depressed

GBP/JPY Technical Analysis: flag breakout in 15-minute chart

About the UK construction PMI

The PMI Construction released by the Chartered Institute of Purchasing & Supply and Markit Economics shows business conditions in the UK construction sector. It is worth noting that the construction sector does not influence, either positively or negatively, the GDP as much as the Manufacturing sector does. A result that values above 50 signals appreciates (or is bullish for) the GBP, whereas a result that values below 50 is seen as negative (or bearish).