USD/CHF Technical Analysis: Another attempt to break 1.0000-1.0010 horizontal resistance

- USD/CHF rises to the day’s high of 0.9970 on early Monday.

- The pair successfully trades beyond 50-day & 100-day SMA confluence and indicates further advances to 1.0000-1.0010 horizontal-resistance.

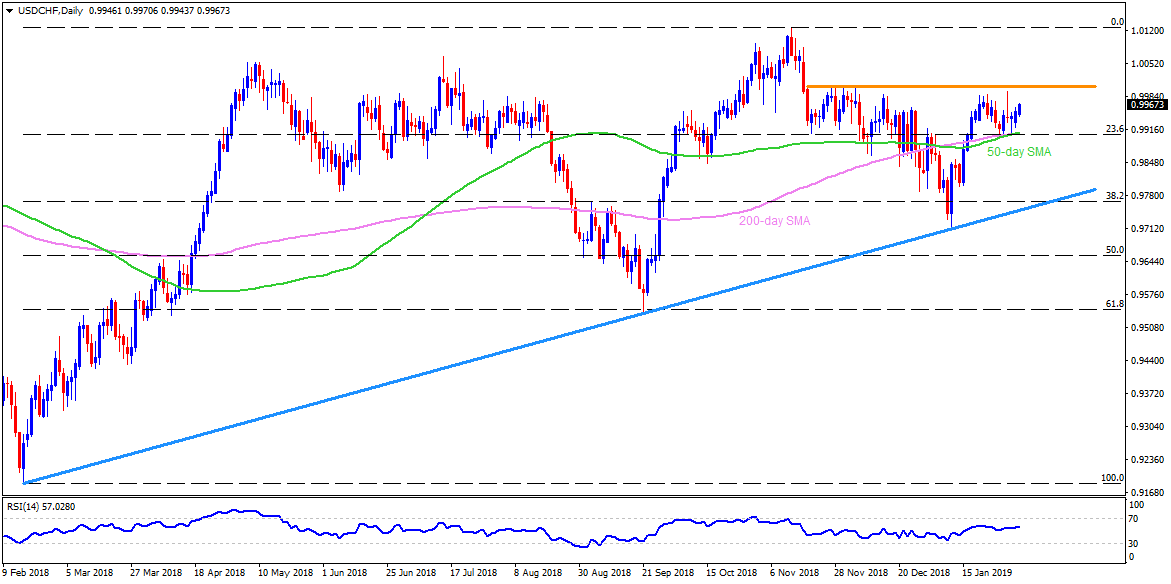

The US Dollar accelerated its recovery against the Swiss France (CHF) with a high of 0.9970 on Monday. The pair reversed from 50-day and 200-day simple moving average (SMA) confluence during last-week and is presently rising towards 1.0000-1.0010 horizontal-resistance.

USD/CHF: Daily chart

Having successfully reversed from 50-day and 200-day SMA confluence during last week, the USD/CHF is rising towards 1.0000-1.0010 horizontal-region.

Should the pair manage to provide a daily closing beyond 1.0010, it can confront the 1.0055 and the 1.0090 numbers to north. Moreover, pair’s successful trading above 1.0090 enables it to revisit the November 2018 high around 1.0130.

In case the pair fails to conquer 1.0010 then the 0.9930 can offer immediate support prior to highlighting the 0.9905-0.9900 support-confluence.

Also, pair’s daily closing under 0.9900 can trigger its pullback to the 0.9855 and the 0.9785 supports whereas an upward slopping trendline since February 2018, at 0.9740, may disappoint sellers afterwards.