GBP/JPY Technical Analysis: Spikes to over 1-month tops ahead of UK jobs data

• The cross built on previous session's strong up-move, led by the EU Chief Brexit Negotiator Michel Barnier's optimistic Brexit comments, and spiked to over one-month tops in the last hour.

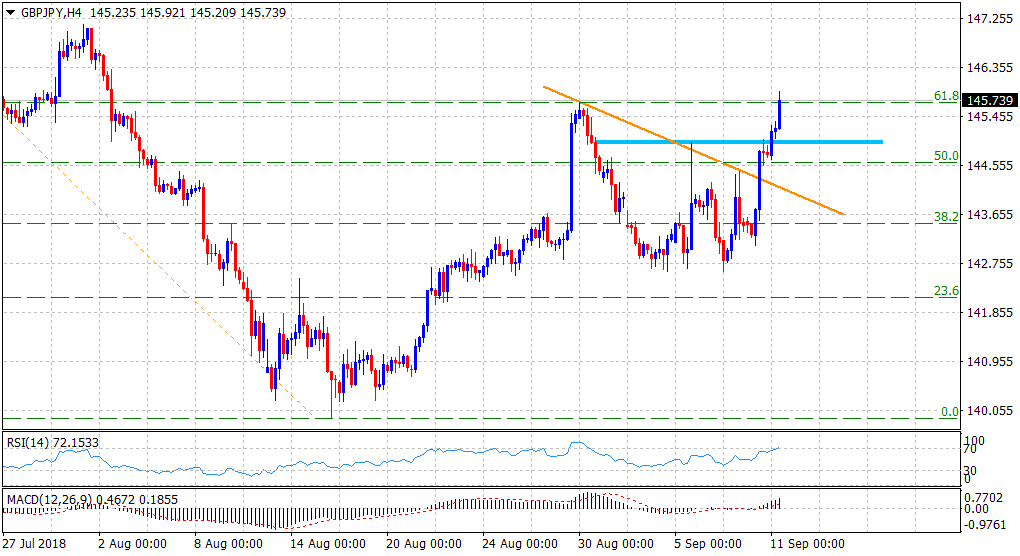

• A sustained move beyond the key 145.00 psychological mark was seen as a key trigger for the bulls, especially after an overnight bullish break through a short-term descending trend-line resistance.

• A follow-through up-move beyond 61.8% Fibonacci retracement level of the 149.31-139.90 downfall further reinforces a near-term bullish breakout and increase prospects for additional gains.

• However, technical indicators on hourly charts have started moving into overbought territory and might turn out to be the only factor keeping a lid on any further up-move ahead of the UK monthly jobs data.

GBP/JPY 4-hourly chart

Spot Rate: 145.74

Daily Low: 144.66

Trend: Bullish

Resistance

R1: 146.10 (100-day SMA)

R2: 146.40 (horizontal zone)

R3: 147.15 (Aug. 1 swing high)

Support

S1: 145.55 (horizontal zone)

S2: 145.00 (psychological round figure mark)

S3: 144.66 (current day swing low)