Back

11 Sep 2018

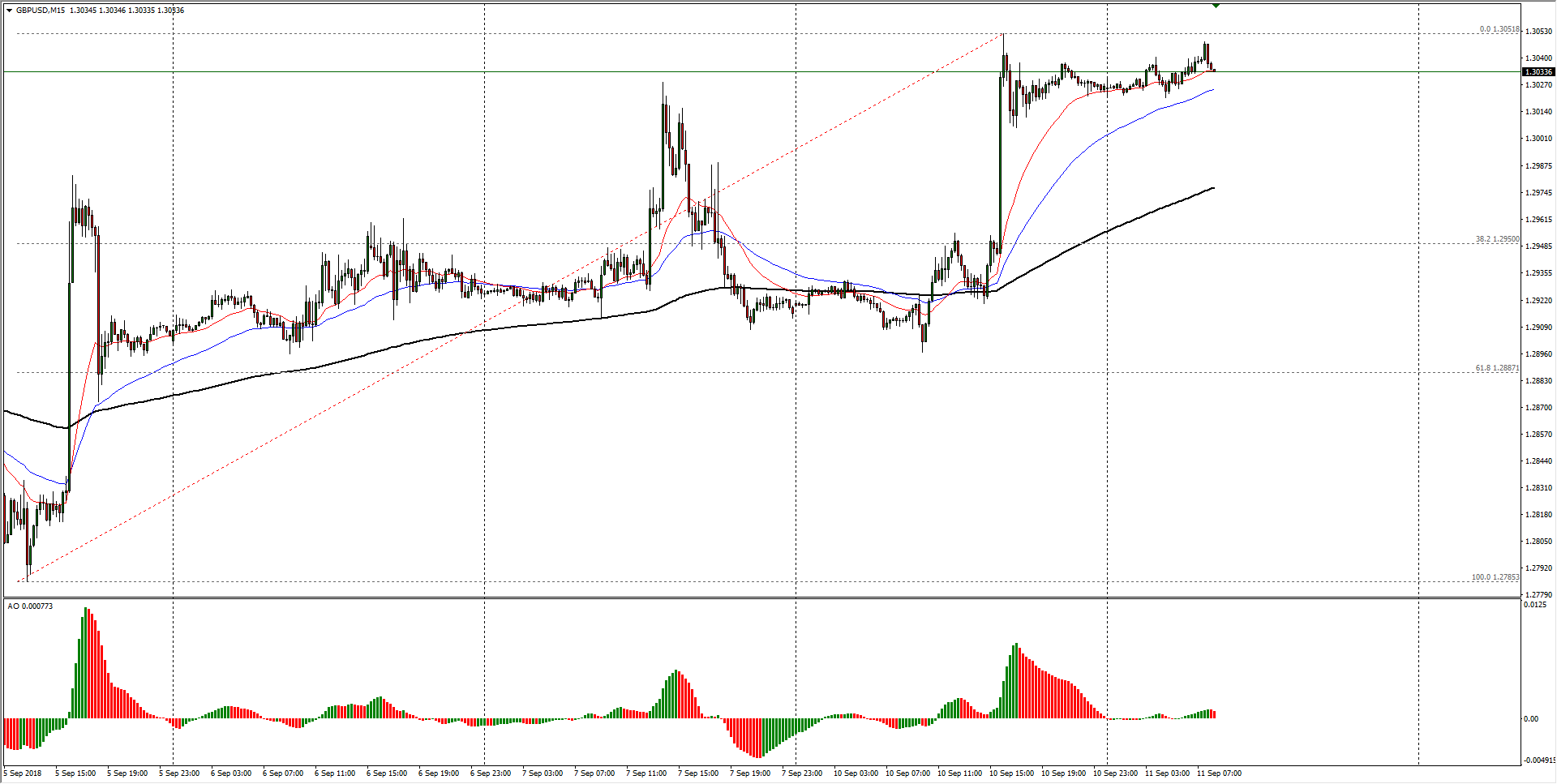

GBP/USD Technical Analysis: double curveball on Brexit headlines

- EU negotiators indicating that a workable Brexit plan could materialize in "6 to 8 weeks", while Eurosceptic Tories saw their latest plan to present their own Brexit plan fell apart, prompting a second Brexit hope rally in two weeks.

- Sterling traders should watch out for an overextended bull run which could prompt sellers to step back in.

- UK earnings report due today could also be a wrench in the works, while a positive reading could easily see an extension.

GBP/USD Chart, 15-Minute

| Spot rate: | 1.3033 |

| Relative change: | 0.06% |

| High: | 1.3048 |

| Low: | 1.3020 |

| Trend: | Bullish |

| Support 1: | 1.2950 (38.2% Fibo retracement) |

| Support 2: | 1.2898 (current week low) |

| Support 3: | 1.2785 (previous week low) |

| Resistance 1: | 1.3050 (major technical barrier, current week high) |

| Resistance 2: | 1.3213 (July 26th swing high) |

| Resistance 3: | 1.3305 (200-day EMA) |