Back

11 Sep 2018

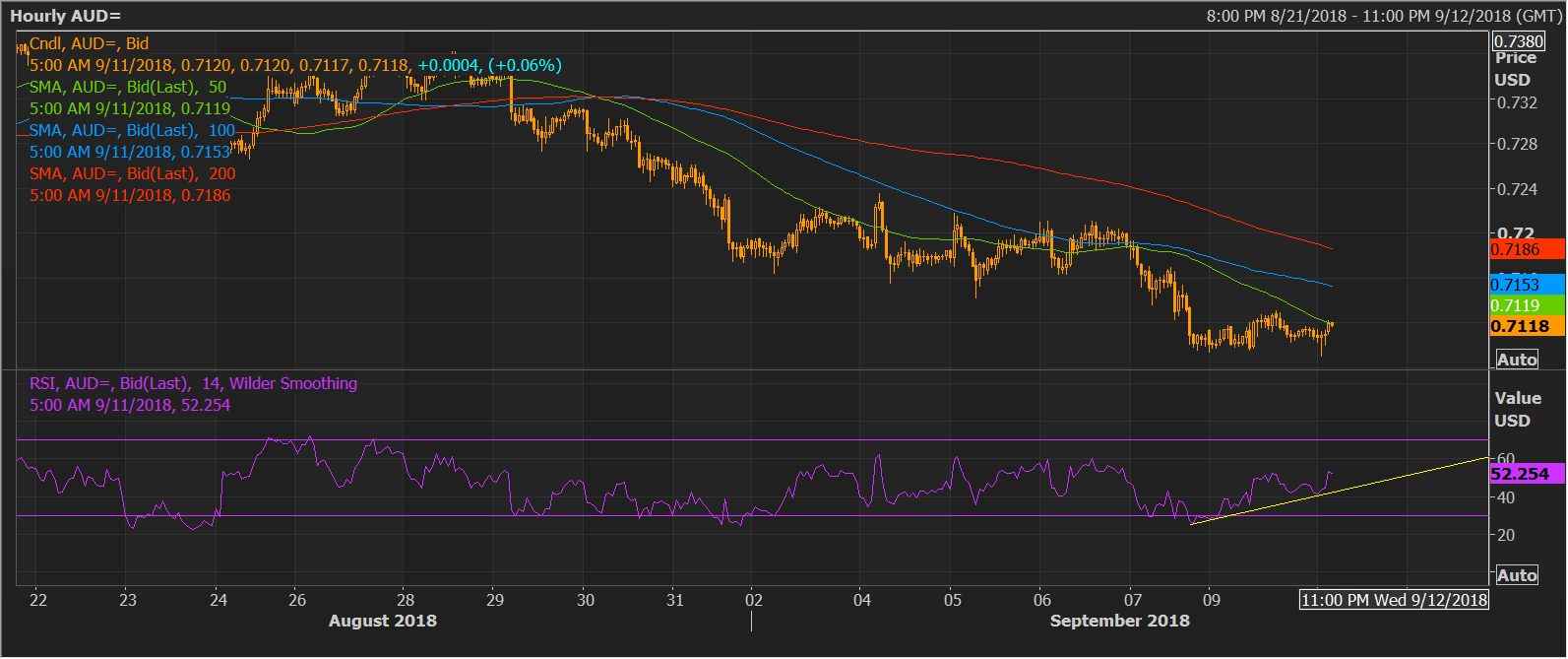

AUD/USD Technical Analaysis Eyeing relief rally after inverted bullish hammer

- The AUD/USD pair created a bullish inverted hammer yesterday. Further, it qualifies as a bullish inside-day candle. As a result, today's close is pivotal.

- A close today above previous day's high of 0.7132 would indicate that the AUD has made a temporary low at 0.7092 and could yield sideways to positive action in the next few days.

- The bullish divergence of the hourly relative strength index (RSI) and the 4-hour chart RSI does signal a scope for a positive close above 0.7132.

Hourly chart

Daily chart

-636722353585377384.png)

Spot Rate: 0.7118

Daily High: 0.7122

Trend: Bullish

Resistance

R1: 0.7145 (Sep. 5 low)

R2: 0.7185 (10-day moving average)

R3: 0.7202 (Aug. 15 low)

Support

S1: 0.7081 (pivot S1)

S2: 0.7048 (pivot S2)

S3: 0.70 (psychological support)