Back

5 Sep 2018

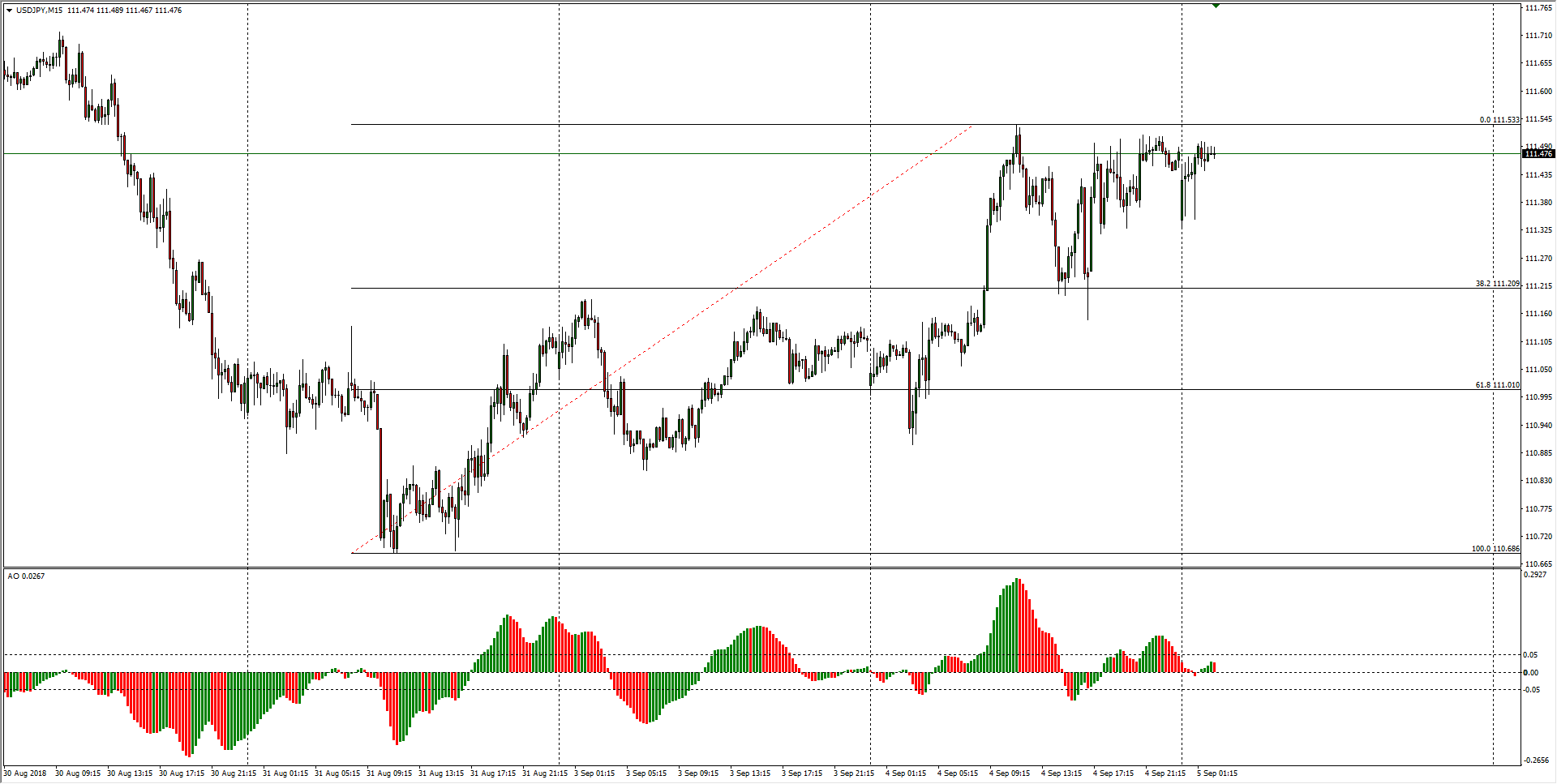

USD/JPY Technical Analysis: Dollar bulls looking to claim high ground

- USD traders have continued a bullish recovery against the safe-haven Yen from last week's low as Dollar flows continue to edge bullish despite "overbought" calls.

- NFP Friday looms ahead, action could tighten ahead of the major reading.

- A messy resistance range well into the 112.00 region will likely see a clean bullish trend face stiff rejections.

USD/JPY Chart, 15-Minute

| Spot rate: | 111.47 |

| Relative change: | 0.11% |

| High: | 111.50 |

| Low: | 111.32 |

| Trend: | Bullish |

| Support 1: | 111.32 (current day low) |

| Support 2: | 110.90 (previous day low) |

| Support 3: | 110.68 (previous week low) |

| Resistance 1: | 111.53 (current week high) |

| Resistance 2: | 111.82 (previous week high) |

| Resistance 3: | 112.00 (major technical level) |