Gold Review: Weekly trading range intact ahead of US CPI

• Resurgent USD demand keeps exerting some downward pressure.

• Fed rate hike expectations further contributed to the weaker tone.

• Risk-off mood extends some support and helps limit deeper losses.

• Today’s US CPI might assist determine the next leg of directional move.

Gold traded with a mild negative bias for the second consecutive session but remained within a narrow trading range held over the past one week or so.

The commodity's attempted up-move on Thursday quickly fizzled out, with a combination of negative forces prompting some fresh selling from closer to weekly tops. Chicago Fed President Charles Evans' hawkish comments, reaffirming prospects for gradual Fed rate hike path through the end of 2018, triggered a fresh leg of US Dollar upsurge and eventually prompted some fresh selling around the non-yielding yellow metal.

A strong follow-through USD buying interest kept exerting downward pressure on the dollar-denominated commodity, albeit the prevailing risk-off mood, as depicted by a sea of red across global equity markets, underpinned the precious metal's safe-haven appeal and helped limit deeper losses, at least for the time being.

Moving ahead, today's important release of the latest US consumer inflation figures will now be looked upon for the required momentum, which could assist the commodity to finally breakthrough its near-term consolidative range.

Technical Analysis

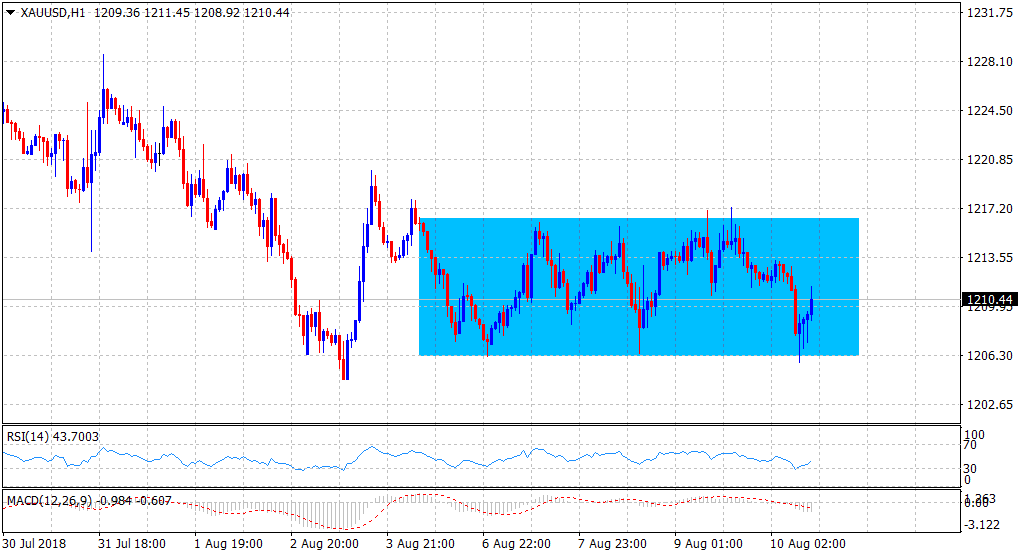

The near-term range-bound price action constituted towards the formation of a rectangular chart pattern on the 1-hourly chart, suggesting a brief pause in the trend. The pattern, however, is not complete until a decisive breakout in either direction has occurred and hence, it would be prudent to wait before positioning for a firm near-term direction.

A convincing break below the $1206-05 region might turn the metal vulnerable to break below the $1200 handle and head towards testing March 2017 lows, around the $1295 level. Alternatively, a sustained move beyond $1217-18 area (trading range resistance) is likely to trigger a short-covering bounce towards $1223-24 intermediate hurdle en-route $1231-32 supply zone.