USD/JPY Technical Analysis: Bulls losing steam below 112.00 level

- The FOMC announced that it left the target interest rates unchanged in 1.75-2.00% range and USD/JPY fell to the 111.39 support from which it is now rebounding.

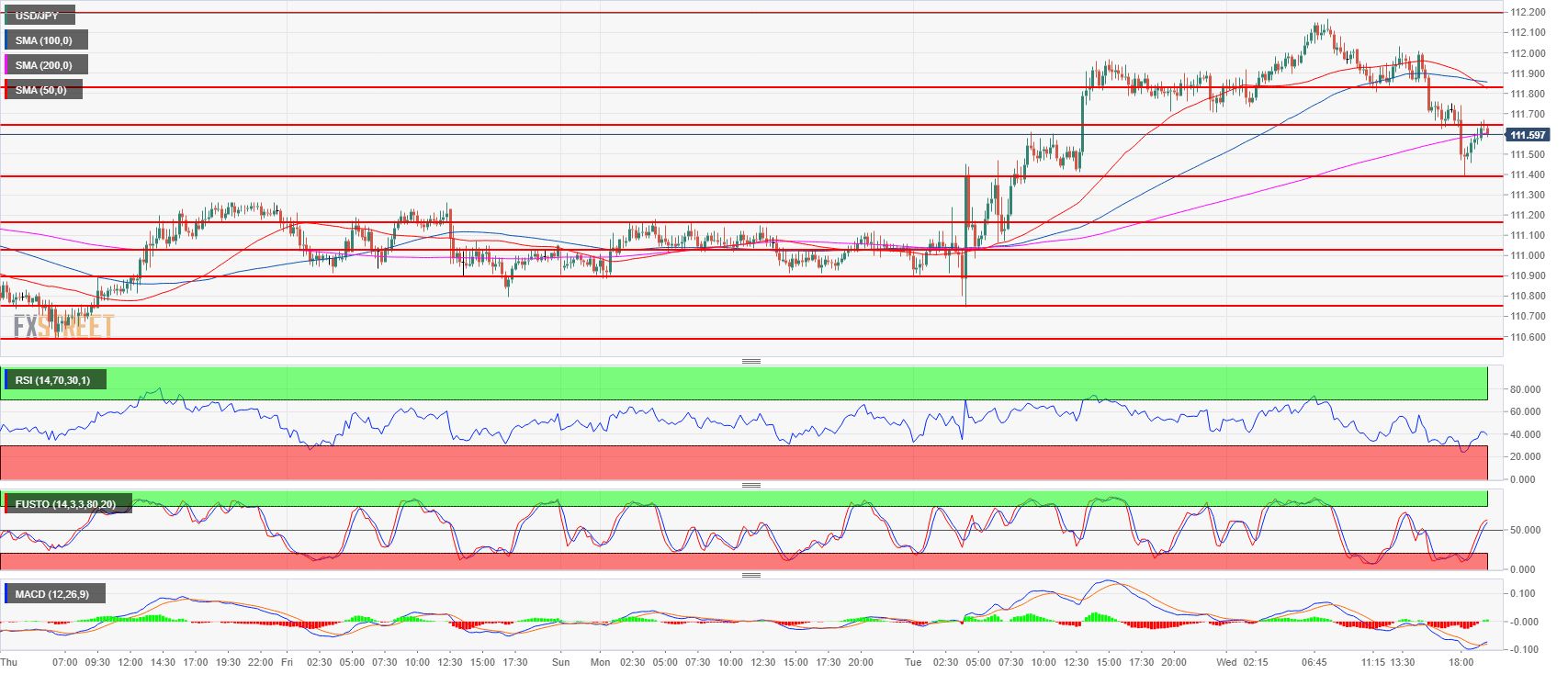

- USD/JPY is trying to regain the ground lost on Wednesday as it trying to keep prices above the 200-period simple moving average (SMA). The 50 SMA crossed below the 100 SMA suggesting that the market is now losing some bullish momentum in the near-term.

- Failure to recapture 111.82-112.00 would be seen as a bearish sign. Supports lie at 111.39 and 111.02-111.16 area.

USD/JPY 15-minute chart

Spot rate: 111.61

Relative change: -0.22%

High: 112.17

Low: 111.39

Trend: Bullish / Bearish reversal risk below 111.82-112.00

Resistance 1: 111.64 supply/demand level

Resistance 2: 111.82-112.00 area, supply level and figure

Resistance 3: 112.19-112.40 area, July 11 high and intraday swing low

Resistance 4: 112.64 July 12 high

Resistance 5: 113.18, 2018 high

Resistance 6: 113.26-113.38, 200-weekly simple moving average and January 8 high

Resistance 7: 114.45 October 27, 2017 high

Support 1: 111.39 May 21 swing high

Support 2: 111.02-111.16 area previous intraday swing lows

Support 3: 110.90 June 15 swing high

Support 4: 110.75, July 23 low

Support 5: 110.58 July 26 low

Support 6: 110.27 July 4 low