Our best spreads and conditions

About platform

About platform

The AUD/JPY is falling back amidst a resurgence in trade war fears following headlines that the US is likely to be announcing further tariffs on Chinese goods.

The news, originally broken by Bloomberg citing anonymous sources, stated that the US is seeking further tariffs on $200 billion USD of Chinese imports, and the new tariff list is expected to be announced Tuesday evening US time. The caveat that the tariffs won't come into effect until after the usual public commenting period followed closely behind, but broader markets are dropping risk appetite and piling into safe-haven assets like the Japanese Yen.

The Aussie, which sees the Westpac Consumer Confidence Survey at 00:30 GMT (last 0.3%) and Home Loans figures (forecast -1.9%, last -1.4%), is already rapidly losing ground against the JPY, which will be seeing Machinery Orders (forecast -5.5%, last 10.1%) late Tuesday at 23:50 GMT, and risk aversion is only going to be swinging further into the red.

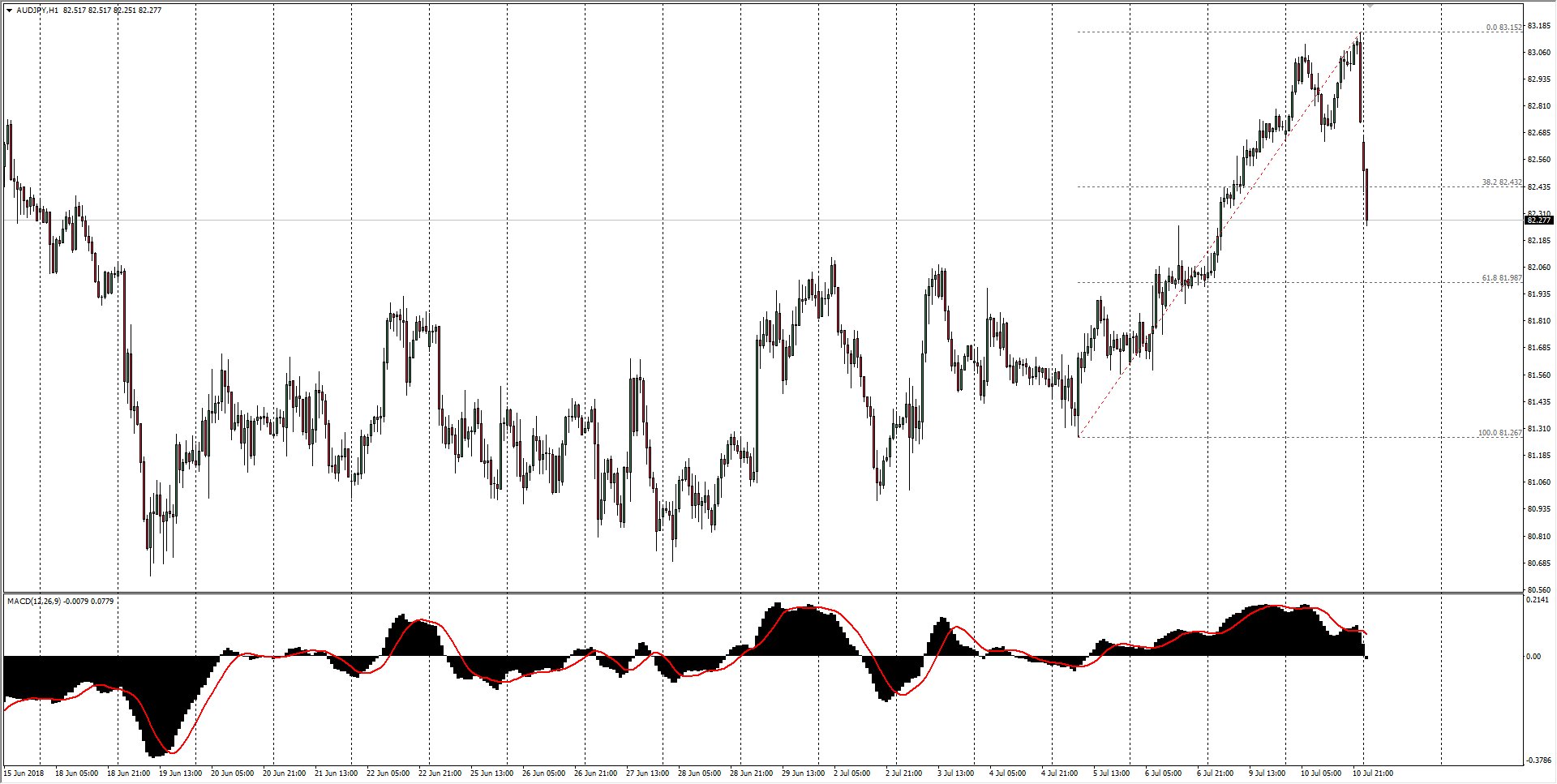

AUD/JPY Technical Analysis

The Aussie was only able to briefly mount the 83.00 major level against the JPY, and trade fears are knocking the AUD back into bearish territory for Wednesday.

| Spot rate: | 82.27 |

| Relative change: | -0.45% |

| High: | 82.66 |

| Low: | 82.25 |

| Trend: | Sharply bearish |

| Support 1: | 81.98 (61.8% Fibo retracement level) |

| Support 2: | 81.26 (July 5th swing low) |

| Support 3: | 80.97 (previous week low) |

| Resistance 1: | 82.66 (current day high) |

| Resistance 2: | 83.15 (current week high) |

| Resistance 3: | 84.00 (major technical level) |

AUD/JPY Chart, 15-Minute