Our best spreads and conditions

About platform

About platform

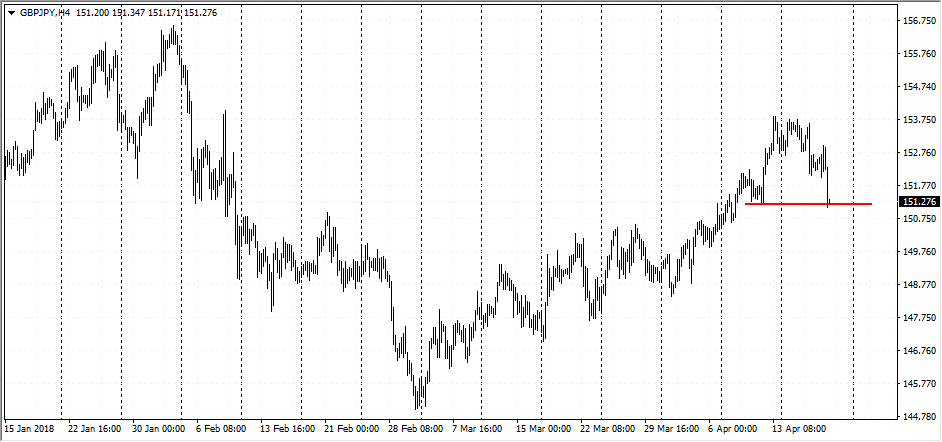

The GBP/JPY continues to trade near the bottom after losing ground yesterday, and the pair is trading near 151.30.

The Sterling had a bad Thursday, with Retail Sales figures all missing the mark Thursday, coupled with the Bank of England's (BoE) Mark Carney's comments all sending the Sterling lower. Carney came across as notably dovish for markets' preferences, as a continuous stream of poorly-performing economic data for the UK has left the BoE on unsure footing ahead of a highly-anticipated rate hike in May.

The selloff continued into the New York session, where risk assets fell as markets bid up the US Dollar and the Yen against the broader markets. The GBP/JPY fell from Thursday's high of 152.95 into 151.10, and the pair is struggling to develop momentum for a recovery as Japanese inflation fails to improve once more.

Japan's National CPI figures came in at the 0.5 percent expectation, but the Bank of Japan's (BoJ) 2 percent target is beginning to look grim as inflation continues to droop in the Japanese economy.

GBP/JPY Levels to watch

The pair is now challenging the last swing low at 151.20, and a break lower could see the pair running into support from the previous resistance zone near 150.40. The pair still has a chance to recover the bullish trend that has been in place since February's low at the 145.00 major level, but a bullish correction from here will have to first contend with the 50.0 Fibo level at 152.50.