Gold: $1310 support at risk amid better than expected US data

- The greenback is strong on Friday with industrial data, JOLTS and Michigan sentiment index.

- Gold bulls might be running out steam as they get tired to defend 1310.

Gold is trading at around 1311.50 down 0.22% on Friday despite mounting hostilities over the attempted murder of a former Russian spy on the UK soil, which triggered geopolitical uncertainties. The precious metal fell to 2-week lows versus the USD following stronger than expected US industrial output data coming at 1.1% vs 0.3% forecast and JOLTS job openings in January coming at 6.312m vs 8.890m forecast. The Michigan consumer sentiment index came in at 102.0 vs 99.3 forecast which is all good news for the greenback which saw a breakout in the Dollar index from 89.90 to 90.37 in the US session.

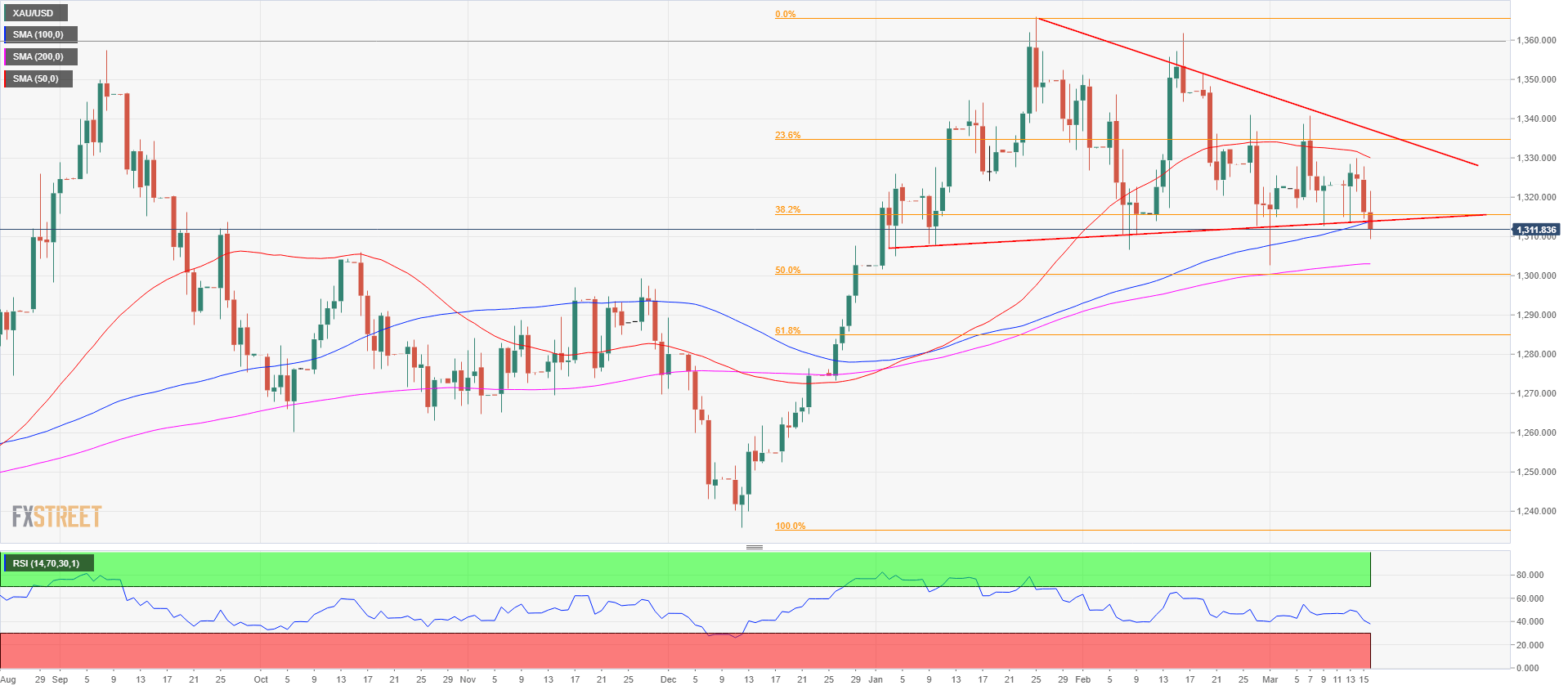

Gold daily chart

Gold is capped by its daily 50-period simple moving average where it has acted as dynamic resistance since about a month. The 1310 support has proven to be quite reliable since the start of 2018 with bulls buying aggressively after any incursion below the 1310 level. Now the both the 100 and 200-period simple moving average are coming to the rescue and only time will tell if they can additionally provide the support that gold needs. It is worth noting that gold is evolving in a triangle compression pattern and that the range is getting increasingly smaller. Since the start of January the market has never been able to close below the 1310 level so if the bears are able to so today, the market will certainly pay attention and maybe start wondering if the range may not be showing signs of weakness. Since February there have been two strong attempts to break 1310; the first one is February 8 and the second is March 1. Today has only broken slightly below 1310 and we need to wait until the end of the day to see whether the bears can close below the support level, in which case we might expect further downside.