Our best spreads and conditions

About platform

About platform

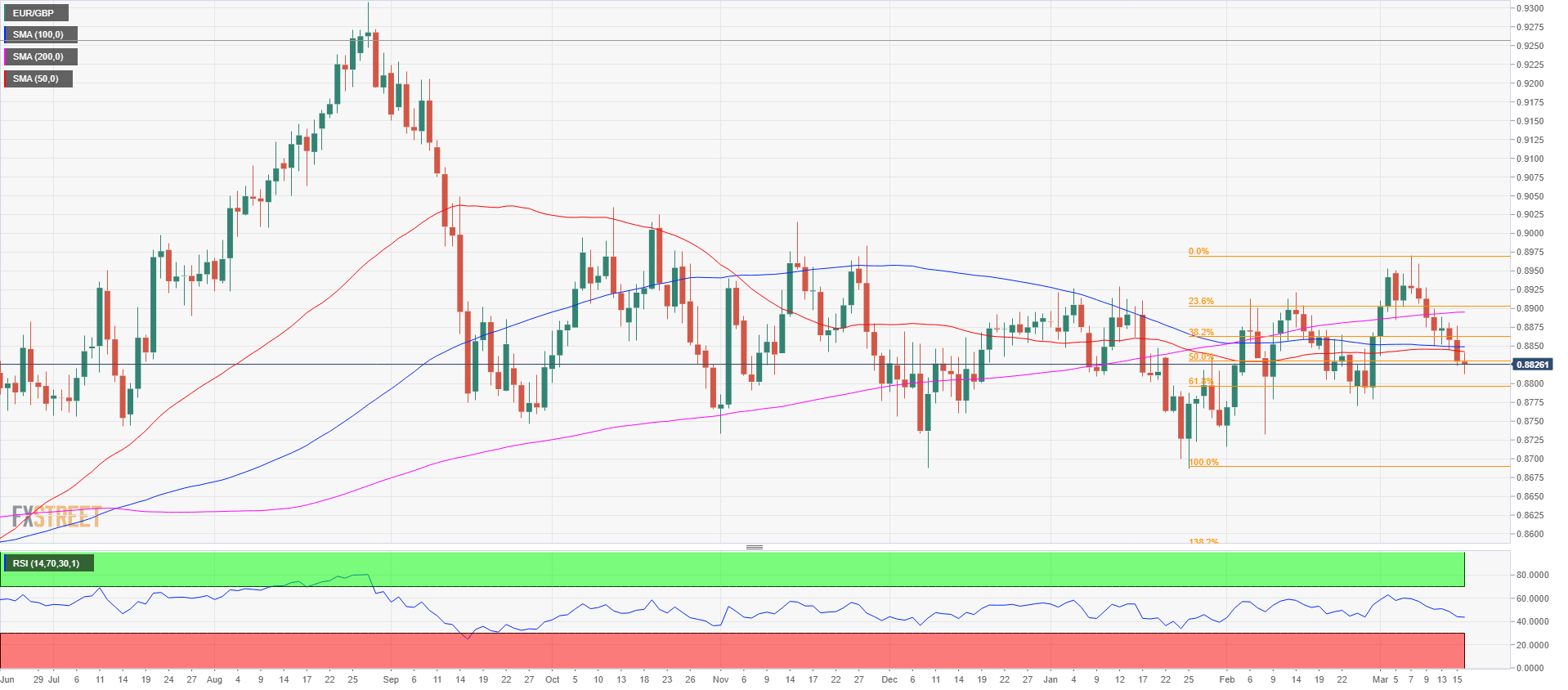

The EUR/GBP is currently trading at around 0.8820 virtually unchanged on the day as earlier in the European session Eurozone CPI data came out mixed.

Next week is going to be significant for the British Pound. According to ING analysts, there are several factors that can influence the GBP. If the Brexit transition deal, at the March EU leader summit, finds a positive outcome, it will likely boost the pound. A successful EU-UK trade deal means a stronger UK economy, and this can reinforce the Bank of England hawkish stance. Also affecting the GBP next week are the core CPI readings, on Tuesday, which should stay at 2.6% y/y according to ING analysts. On Wednesday, wage inflation is expecting higher while February UK retail sales are expected to decrease a little but the market might be indulgent given the weather-related disruptions.

Earlier in the European session, Eurozone CPI data came out mixed.

EUR/GBP daily chart

Support is seen at the 0.8800 level which is the 61.8% Fibonacci retracement from the January 25 to March 7 bull move. The pair has broken below both its 100 and 200-period simple moving average, however, in a trading range environment, it is less significant as traders tend to favor return to the mean strategies. If bears can sustain the momentum the next support is seen at 0.8700 low of the range. On the flip side resistance 0.8860 which is the 38.2% Fibo, followed by the high part of the range at 0.8950 seen earlier in the week.