Back

26 Feb 2018

GBP futures: upside could be short-lived

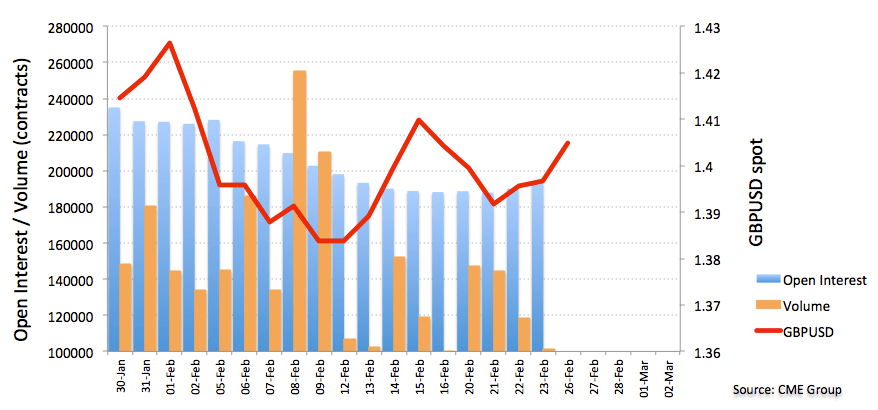

CME Group’s advanced data for GBP futures markets noted investors added more than 3K contracts on Friday vs. Thursday’s final 190,132 contracts. On another hand, volume went down by more than 17K contracts.

GBP/USD relevant hurdle lies near 1.4100

Cable’s recent up move has been in tandem with an uptick in open interest, although the down move in volume as of late could leave further rallies capped in the 1.41 neighbourhood, where is located the resistance line off 2018 tops.

Renewed Brexit optimism plus the a somewhat hawkish BoE has been propping up the better tone in GBP.