When are UK data releases and how could they affect GBP/USD?

UK Economic Data Overview

The UK industrial production and trade balance data for the month of September are scheduled for release at 0900 GMT in the European session ahead.

The manufacturing production, which makes up around 80% of total industrial production, is expected to move out of contraction to ease to 0.3% on monthly basis in Sept, against a 0.4% expansion seen in August. Meanwhile, the total industrial production is also expected to show a 0.3% increase m/m in Sept, as compared to a 0.2% gain recorded previously.

On an annualized basis, the industrial production for Sept is expected to come in a tad better, by 1.9% versus 1.6% previous, while the manufacturing output figures are seen arriving at 2.4% in the reported month versus 2.8% last.

Separately, the UK goods trade balance is expected to come in at GBP -12.80 billion in Sept vs GBP -14.245 billion last, while the construction output is expected to drop sharply by -0.6% vs 0.6% previous.

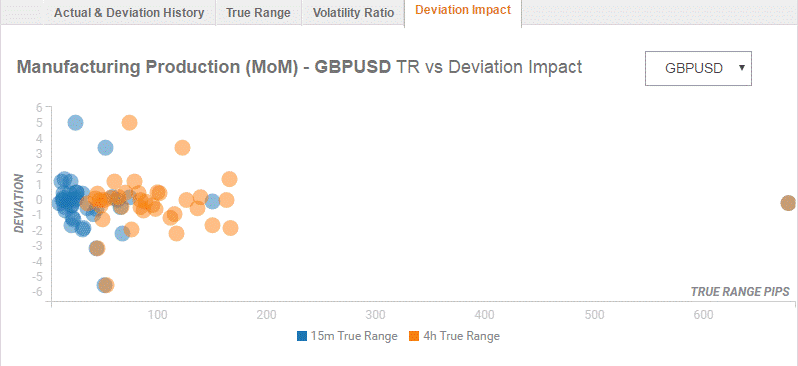

Deviation impact on GBP/USD

Readers can find FX Street's proprietary deviation impact map of the event below. As observed the reaction is likely to remain confined between 20 and 35 pips in deviations up to 1.5 to -2.2, although in some cases, if notable enough, a deviation can fuel movements of up to 60 pips.

Readers can find FX Street's proprietary deviation impact map of the event below. As observed the reaction is likely to remain confined between 20 and 35 pips in deviations up to 1.5 to -2.2, although in some cases, if notable enough, a deviation can fuel movements of up to 60 pips.

How could affect GBP/USD?

The UK releases are likely to have a bearing on the GBP markets, as they queue up for the first batch of relevant macro news from the UK docket this week.

Better-than-expected data could offer some respite to the GBP bulls, which could drive the rate back beyond 1.3150 levels, above which the doors open up for a test of 1.3177/80 (classic R1/ Fib R3). However, GBP/USD could breach 1.3100 support, should the indicators disappoint.

Key notes

UK: Focus on industrial production and trade data - Nomura

UK Data and Brexit Negotiations Key on Friday

About UK manufacturing production and trade balance

The Manufacturing Production released by the Office for National Statistics (ONS) measures the manufacturing output. Manufacturing Production is significant as a short-term indicator of the strength of UK manufacturing activity that dominates a large part of total GDP. A high reading is seen as positive (or bullish) for the GBP, while a low reading is seen as negative (or bearish).

The trade balance released by the Office for National Statistics (ONS) is a balance between exports and imports of goods. A positive value shows trade surplus, while a negative value shows trade deficit. It is an event that generates some volatility for the GBP.