Our best spreads and conditions

About platform

About platform

Crude oil prices are recovering the smile on Monday, currently lifting the West Texas Intermediate beyond the $46.00 mark per barrel, or daily highs.

WTI firmer ahead of OPEC meeting

Prices for the barrel of the American benchmark for the sweet light crude oil are reverting two consecutive sessions with losses, now looking to add momentum to the rebound from Friday’s lows in the mid-$45.00s and gain extra steam following today’s breakout of the key $46.00 mark.

WTI started the week on a firm note ahead of the upcoming meeting between key OPEC producers and Russia, where countries are expected to assess the current market conditions. Nigeria and Libya, which are currently not part of the OPEC deal and have been increasing their production in past months, will also attend the gathering.

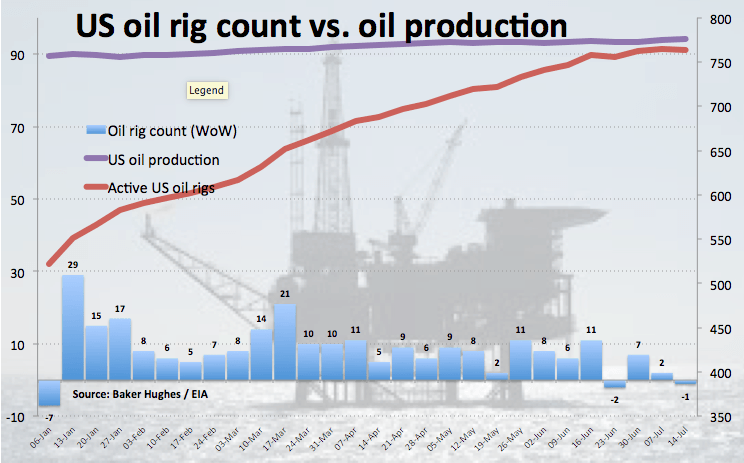

Also collaborating with the daily upside, Friday’s report by driller Baker Hughes saw the US oil rig count dropping by 1 to 764 active oil rigs. It is worth mentioning that US oil rig count decreased just 3 times this year (weeks ended on January 6, June 23 and July 14).

Further news from the positioning space, crude oil speculative net longs have climbed to the highest level since late April during the week ended on July 18, according to the latest CFTC report.

WTI levels to consider

At the moment the barrel of WTI is gaining 1.01% at $46.23 and a surpass of $46.63 (55-day sma) would aim for $47.55 (monthly top Jul.20) and finally $48.01 (100-day sma). On the other hand, the next support aligns at $45.85 (38.2% Fibo of the May-June decline) seconded by $45.75 (21-day sma) and finally $44.99 (low Jul.13).