USD/TRY retreats from highs, still up 1.5% on the day

The upside momentum surrounding the USD/TRY pair has accelerated following the strong ADP data and carried the pair to its daily high at 3.7471. Although the pair gave back some of its earnings after the initial reaction, it's still gaining 1.5% on the day.

CBRT signals more tightening possible (via Reuters)

Turkish industrial production data on Wednesday showed a continuation of a recovery in economic activity and initial indicators signal a stronger recovery from the second quarter, Central Bank Governor Murat Cetinkaya said on Wednesday.

In a speech at a business conference in the western city of Denizli, Cetinkaya also said structural reforms were important for a permanent solution on inflation and that the impact of measures taken in January was exactly as planned.

According to the daily report published by BBH Global Currency Strategy Team, January IP rose 2.6% y/y vs. 1.8% expected, but this had little impact on trading. The economy is sluggish, but the central bank cannot ease in light of rising inflation. February CPI rose 10.13% y/y vs. 9.74% expected despite the firmer lira last month. This is further above the 3-7% target range. Recent lira weakness and the 15.36% y/y surge in PPI suggest price pressures are intensifying. Next policy meeting is March 16, and further tightening is likely by adjusting the rates corridors again.

USD boosted by ADP

The probability of a March rate hike jumped to 91% following the data and DXY leaped above 102. The positive ADP numbers could change the expectations of Friday's NFP data as, in recent months, the correlation between ADP and NFP has improved.

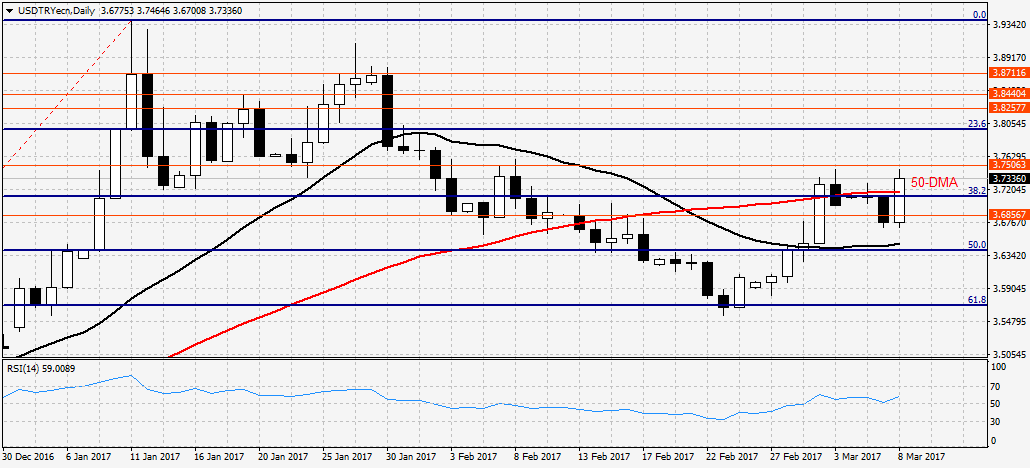

Technical levels

Technical resistances for the pair are aligned at 3.75 (psychological level/Jan. 23 low), 3.7590 (Feb. 8 high) and 3.7740 (Feb. 2 high). On the other hand, the first support could be found at 3.7170 (50-DMA), followed by 3.70 (psychological level) and 3.6850 (static level).