Our best spreads and conditions

About platform

About platform

The US dollar rose sharply across the board during Janet Yellen’s testimony before the Senate Banking Committee. During the second half of the American session, the greenback pulled back, trimming some gains.

“Fed Chair Yellen's testimony to the Senate opened the door to a March hike, causing US interest rates and the US dollar to jump in response. Equities were unharmed, the S&P500 making a fresh record high afterward”, described analyst from Westpac. According to them, Yellen sounded upbeat on the labour market and put a March rate hike on the table without explicitly saying so.

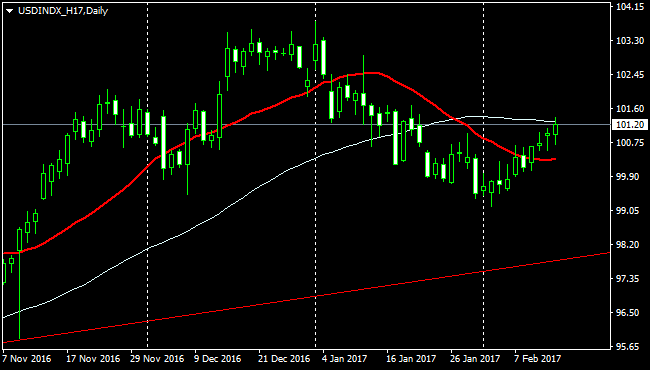

Equity indexes in Wall Street were headed toward new record close levels. Despite the risk appetite environment the US dollar index, supported by rising bond yields, rose for the fourth day in a row and it was about to end the day above 101.00, the strongest close since Trump’s inauguration. The index peaked on Tuesday at 101.37, before pulling back to 101.20/25.

Tomorrow Yellen will also present testimony, this time before the House of Representatives (at the Committee on Financial Services). Regarding US data, today the Producer Price Index showed numbers above expectations. On Wednesday will be the turn of the Consumer Price Index and also, the retail sales report will be released.

DXY levels

Resistance levels are seen at 101.35/40 (Feb 14 high), 101.70 (Jan 16 & 19 high) and102.00. On the opposite direction, support might be located at 101.10 (Feb 13 high), 100.65 (daily low) and 100.50/55 (Feb 10 & 13 low).