UK manufacturing production preview: What to expect of GBP/USD?

The UK industrial and manufacturing production data for the month of November are scheduled for release at 09.30 GMT in the European session ahead.

Industrial production likely to make a solid comeback in Nov

The manufacturing production, which makes up around 80% of total industrial production, is expected to stage a solid rebound to 0.5% on monthly basis in Nov, against a 0.9% decrease seen in Oct. Meanwhile, the total industrial production is also predicted to turn positive, and jump 0.8% m/m in Nov, as compared to a -1.3% contraction recorded previously.

The event may cause quite a stir in GBP markets, and a better print could rescue the GBP bulls from Brexit-concerns induced weakness seen so far this week. On a positive result, GBP/USD could resume its bullish run and head for a re-test of 1.22 handle, while if the data fall short of expectations, then the major could drop sharply towards multi-week lows of 1.2104 reached yesterday.

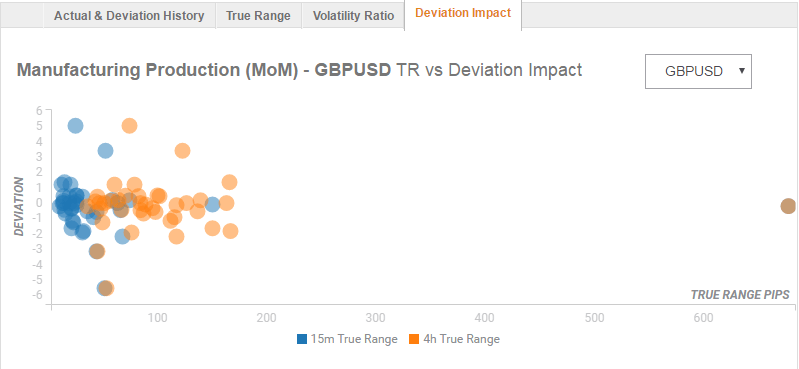

Deviation impact on GBP/USD

Readers can find FX Street's proprietary deviation impact map of the event below. As observed the reaction is likely to remain confined between 20 and 35 pips in deviations up to 1.5 to -2.2, although in some cases, if notable enough, a deviation can fuel movements of up to 60 pips.

GBP/USD technical levels to watch

Haresh Menghani, Analyst at FXStreet noted, “A follow through weakness below 1.2135-30 immediate support is likely to drag the pair back towards 1.2100 handle below which the downward trajectory could further get extended back towards early Oct. flash crash swing lows support near 1.20 psychological mark, with 1.2080-75 area providing some intermediate support.”

“Conversely, sustained recovery move back above 1.2200 handle might trigger a short-covering bounce towards 1.2280-85 resistance before the pair moves back above 1.2300 handle and aim towards testing its next resistance near 1.2335-40 region.”