Our best spreads and conditions

About platform

About platform

The UK economy will release its November construction PMI later in the European session, with the figure expected to arrive a tad weaker, although remain into expansion territory, with a 52.5 print predicted versus previous 52.6 result.

A weaker print of the construction sector PMI may not come as a surprise, given yesterday’s disappointing manufacturing PMI report, as the construction PMI has widely shown the similar behavior as the manufacturing and services PMIs, Analysts Societe Generale said in a research note.

Should the PMI reading surprise to the upside, we could see GBP/USD extending its advances to test two-month tops reached yesterday at 1.2696. Contrarily, the cable could test 1.2550 levels on disappointing results. However, the reaction to the data may remain limited as the main risk event for the major today remains the NFP data due later in the NA session.

Analysts at Danske bank noted, “The November release will give insight into whether the downturn in the construction sector after Brexit continues to ease, despite the financial pressures on the industry from higher input prices due to the weaker GBP. We think there is currently limited upside potential for the construction sector, and estimate the PMI construction index to be unchanged at 52.6 in November.”

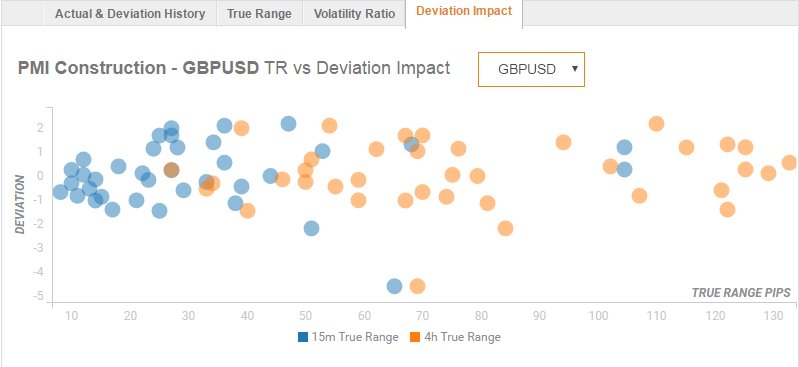

Deviation impact on GBP/USD

Readers can find FX Street's proprietary deviation impact map of the event below. As observed the reaction is likely to remain confined between 10 and 45 pips in deviations up to 2 to -1.4, although in some cases, if notable enough, a deviation can fuel movements of up to 70 pips.

GBP/USD: Technical levels

GBP/USD: Technical levels

Haresh Menghani, Analyst at FXStreet notes, “Despite of its sharp up-move on Thursday, the pair failed to sustain at higher levels and retreated from 1.2700 resistance area, marking 50% Fibonacci retracement level of 1.3439-1.1980 downfall. The pair, however, held above 38.2% Fibonacci retracement level, near 1.2540 region, which now becomes immediate support to defend. Failure to hold this immediate support might now drag the pair back below 1.2500 psychological mark support towards retesting 50-day SMA, resistance turned support, near 1.2450 region.”

“Meanwhile on the upside, momentum back above 1.2650 level, leading to a subsequent break through 1.2675 resistance, now seems to assist the pair to surpass 1.2700 resistance and head towards testing a short-term ascending trend-channel important resistance near 1.2800 handle, also coinciding with 100-day SMA."