Back

7 Jul 2023

Gold Futures: Still room for further losses

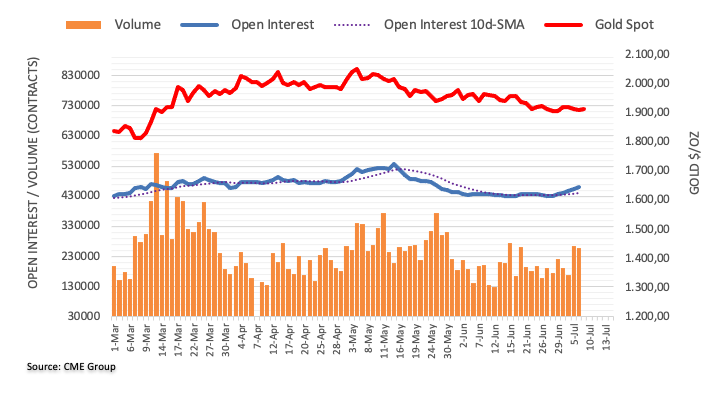

CME Group’s flash data for gold futures markets noted traders extended the uptrend in open interest and added around 9.5K contracts on Thursday. On the flip side, volume resumed the decline and shrank by around 6.2K contracts following the previous daily build.

Gold: Door open to another test of $1890

Gold prices extended the corrective decline on Thursday amidst increasing open interest, which suggests that further losses could be in the pipeline in the short-term horizon. That said, the immediate contention area emerges at the June low at $1893 per troy ounce (June 23).