EUR/JPY Price Analysis: Eyes downtrend amid overbought RSI’s, ECB hawks hold back fall

- EUR/JPY faces a neutral downward trend in the short term.

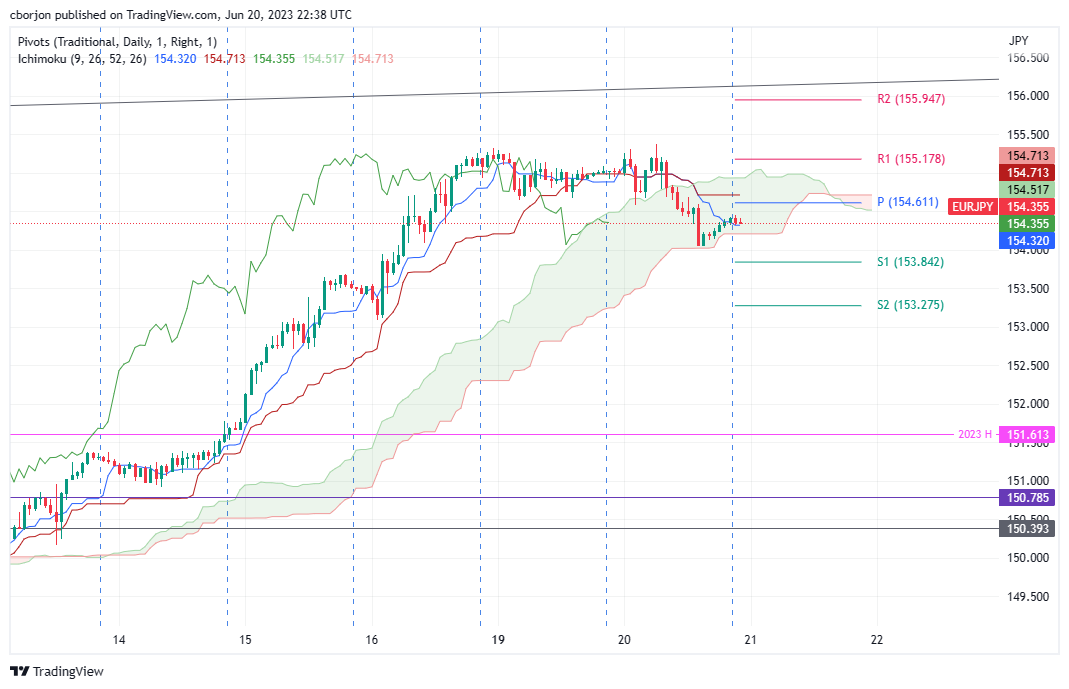

- Key support at Tenkan-Sen, Senkou Span B lines, though the EUR/JPY trades inside the Ichimouku cloud.

- Resistance awaits at 154.61 daily pivots, ahead of breaching the 155.00 figure.

The EUR/JPY drops as the Asian session commences, following a bearish session on Tuesday that witnessed a fall of 0.40%. However, expectations for further tightening by the European Central Bank (ECB) capped the cross’s fall. At the time of writing, the EUR/JPY exchanges hand at 154.37, down 0.02%.

EUR/JPY Price Analysis: Technical outlook

The daily chart portrays the pair in a strong uptrend, though price action is overextended, as the Relative Strength Index (RSI) exists from overbought conditions. That triggered the EUR/JPY downward correction toward the current week’s low of 154.04, but the pair recovered some traction since then.

In the short term, the EUR/JPY 1-hour chart portrays the pair as neutral downwards. Traders must be aware the EUR/JPY is trading inside the Ichimoku cloud; therefore, price action would remain capped withint the Span A and B lines, each at 154.94/154.20.

If EUR/JPY breaks below the Tenkan-Sen line and the Senkou Span B line at around 154.32/20, the EUR/JPY would accelerate its downtrend. The next support would be the 154.00 figure, followed by the S1 daily pivot at 153.84. A decisive break will expose the 153.50, followed by the S2 pivot point at 153.27.

Conversely, the EUR/JPY first resistance would be the daily pivot at 154.61. Once cleared, the Kijun-Sen line is up for grabs at 154.71, followed by the Senkou Span A at 154.94, before cracking the 155.00 figure.

EUR/JPY Price Action – Hourly chart