Back

6 Jun 2023

Natural Gas Futures: Scope for further gains near term

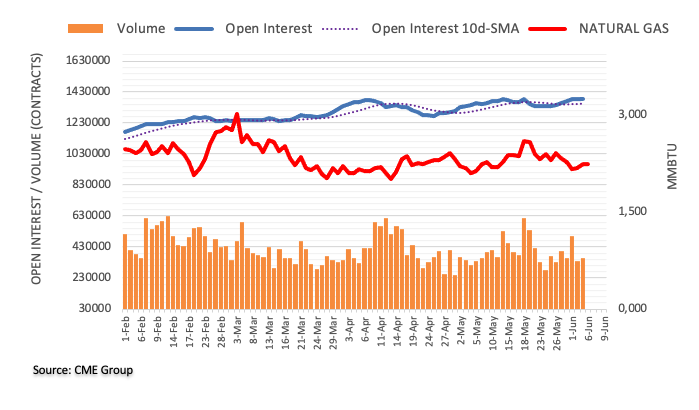

Considering advanced prints from CME Group for natural gas futures markets, open interest resumed the uptrend and went up by around 5.1K contracts on Monday. Volume, in the meantime, remained erratic and rose by around 20.5K contracts following the previous pullback.

Natural Gas remains stuck within the range

Prices of natural gas extended the recovery on Monday against the backdrop of rising open interest and volume, paving the way for the continuation of this trend in the very near term. That said, there is an immediate hurdle around the $2.50 region per MMBtu, although the commodity is largely anticipated to maintain the current multi-week consolidative phase for the time being.