Back

16 Mar 2023

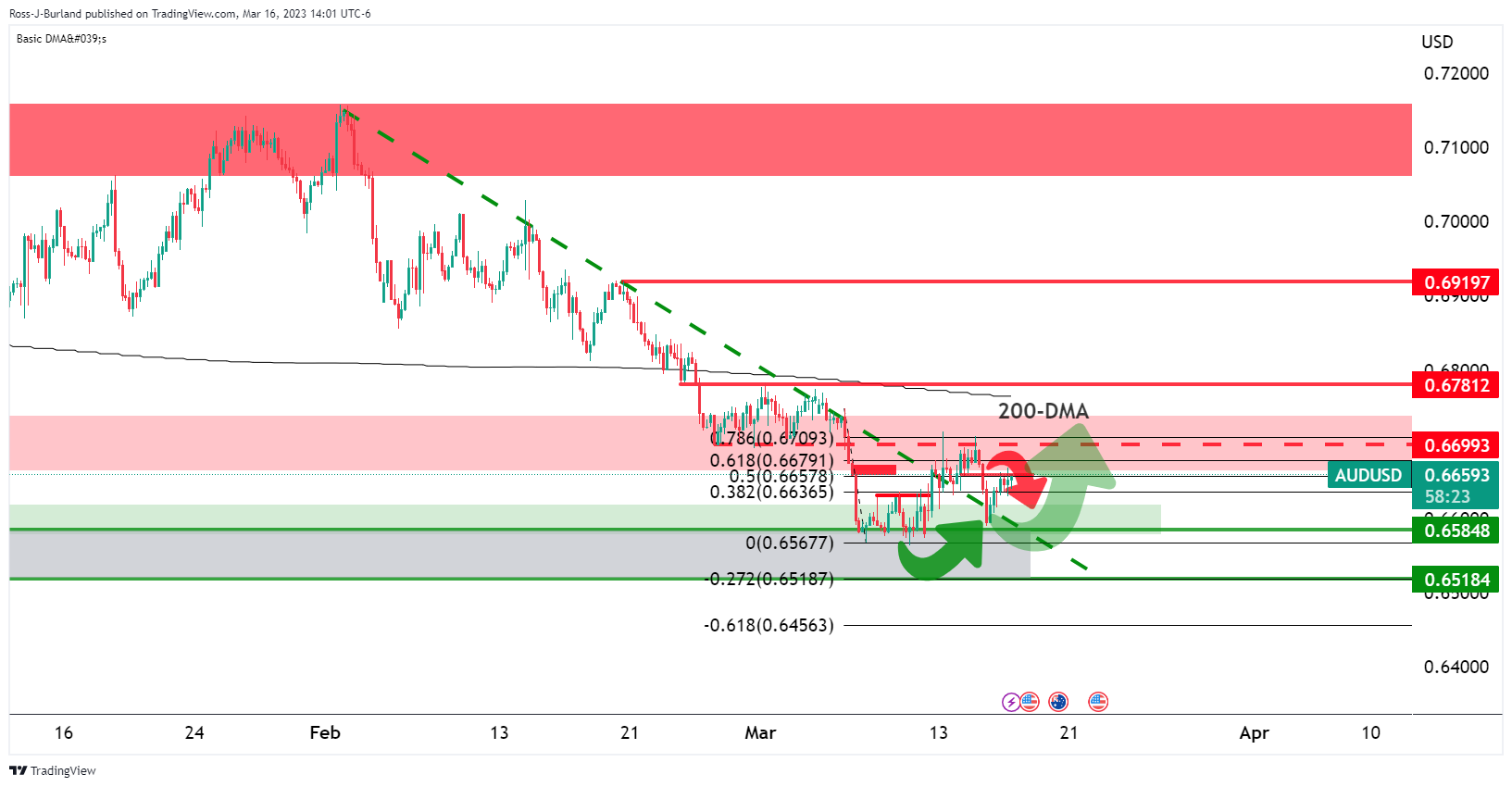

AUD/USD Price Analysis: Bulls are fending off the bears below 200 DMA

- AUD/USD bulls are testing the bears as failures persist on the downside.

- There are prospects of to test 200 DMA and 0.6780.

At the time of writing, AUD/USD is up 0.6% on the day and has traveled from a low of 0.6606 to a high of 0.6668 so far. While pressured below the 200-DMA, AUD/USD is now trading on the backside of the trendline but is yet to break the 0.6700 key resistance level. Bulls are fending off the bears while keeping them back above 0.6580. The following illustrates the market structure on the 4-hour chart:

AUD/USD H4 charts

There is a price imbalance to the downside, greyed area, but so long as the bulls commit to the 0.6580s then there will be prospects of a move to test 200 DMA and 0.6780 as the accumulation process kicks in.