Back

13 Mar 2023

Crude Oil Futures: Extra gains on the cards

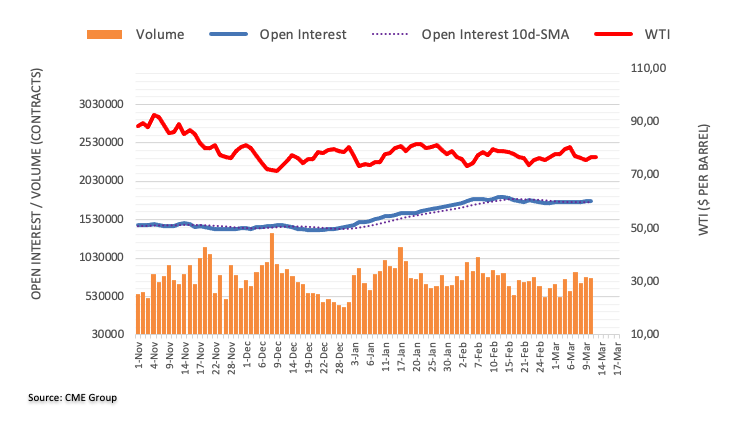

CME Group’s flash data for crude oil futures markets noted traders increased their open interest positions for the fourth consecutive session on Friday, this time by around 1.5K contracts. Volume, instead, remained erratic and went down by nearly 19K contracts.

WTI: Next on the upside comes $80.00 and above

WTI prices regained the smile on Friday after three daily pullbacks in a row. The rebound was amidst increasing open interest and leaves the room open to the continuation of this trend at least in the very near term. The immediate resistance for the commodity lines up at the key $80.00 mark per barrel.